The client, a Private Equity Fund, wants to value their investments every reporting period which is typically every quarter. Since equity investments in private companies do not have observable market inputs which can be reliably used as a basis for valuation, the client wanted to use the Latest Round of Financing or the LRF method for valuation.

To prepare waterfall work papers based on the LRF method to arrive at the value of the fund’s investment in various private companies.

The client provided basic guidelines and shared different valuation models and supplementary legal documents for reference.

The TresVista Team combed through the reference files and performed some background research to identify specific aspects to complete the task such as:

• Understanding relevant metrics surrounding the financing event

• Interpreting and analyzing various legal documents incidental to the financing round like the Term Sheet, Share Purchase Agreement, Company Charter Capitalization Tables, etc.

The final deliverable was broken into two segments:

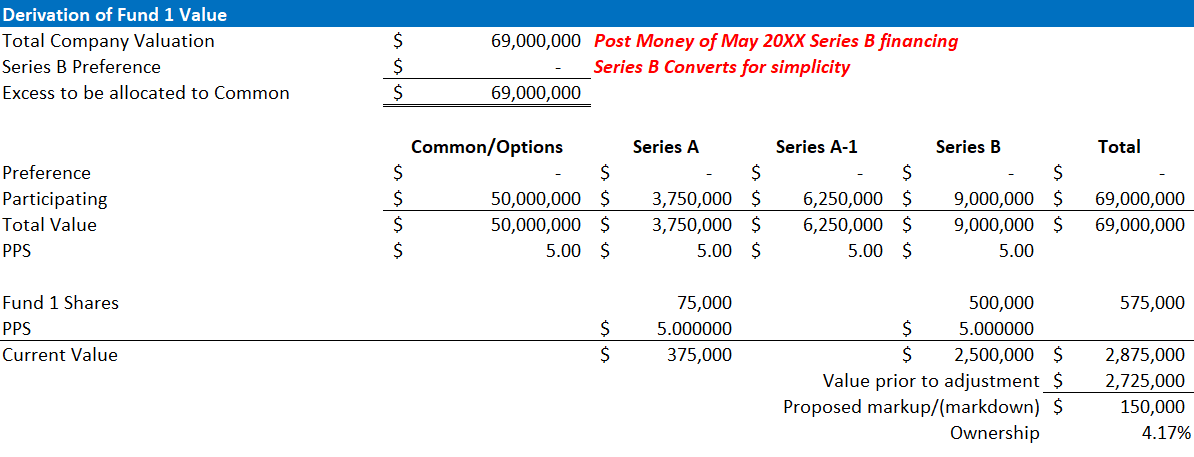

• Waterfall calculation showing the split of total portfolio company valuations across various equity classes within the company

• Arriving at the PE funds investment value by applying the above split

The challenges encountered by the TresVista Team were:

• Understanding the chain of events along with specific jargons in the PE industry

• Interpreting legal documents related to the PE financing and cCapturing/identifying all aspects that have a potential impact on valuation

• Comprehending and deciphering caveats/conditions specific to each round raised

The TresVista Team streamlined the entire process with systematic steps to ensure a timely and efficient way to complete the model.