The client, an Asset Management Firm, was interested in the merger of two food delivery companies and requested the TresVista Team to prepare separate models for the two companies and then build a merger model. The client looked at the merger of the two companies as an investment opportunity as there was a rise in food delivery from the start of the pandemic. The TresVista Team was also asked to assist on the investor presentation which aimed to cover topics like the industry outlook, competitor analysis, and key financial data.

To build a comprehensive financial model and an investor presentation to evaluate an investment opportunity that emerged due to the consolidation of two food delivery leaders in their respective geographies.

The TresVista Team followed the following process:

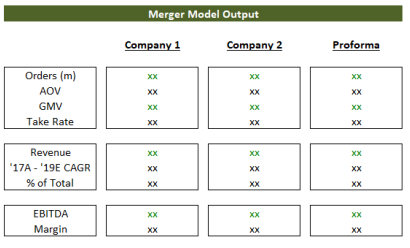

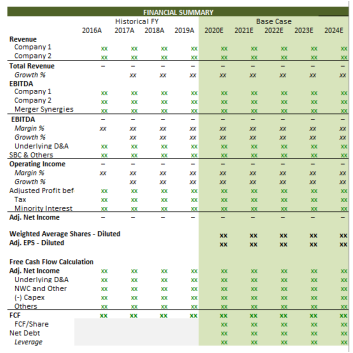

• Prepared two separate models for the two companies and then built a merger model in a common currency

• Prepared a presentation to visually represent the analysis created in the Excel models

• Once the models were ready, The TresVista Team created the investor presentation in which both the companies were analyzed from different viewpoints based on geography, drivers, market position, and business outlook

As the companies involved in the merger were reporting financials in different currencies, the primary hurdle faced by the TresVista Team in building the merger model was in converting the financials of the companies to a common currency. The TresVista Team conducted in-depth research and referenced various research reports to understand the best practices to convert the financials to a common currency.

The TresVista Team analyzed both the businesses individually based on their operating regions and contribution to the overall business and benchmarked order volume, Gross Merchandise Value, AOV, ARPO, market share, revenue growth, EBITDA margins & key competitors in their respective regions. The extensive research conducted by the TresVista Team for the investor presentation helped the client save a significant amount of time and effort.