The client, a Private Equity firm, wanted the TresVista team to conduct research about the target company and its industry, followed by an acquisition model. The client wanted a comprehensive model in which all the individual practices get accounted to the consolidated statement. Apart from this, the client wanted the team to make different switches around which it could toggle around regarding the different tax rates, synergies, and growth factors.

To aid in preparing an LBO Model, a Monthly Acquisition Financial Model, and an Investor Presentation.

The TresVista team followed the following process:

Research: Conducted extensive research on the company and the industry including market dynamics, major KPIs, and competitors

Valuation: Prepared an LBO Model and conducted comparable exercises that estimated the current value of a business

Due Diligence: Arrived at fund level calculations for contributions to Investments, Management Fee, Carried interest, etc., to calculate Net IRR and MoC

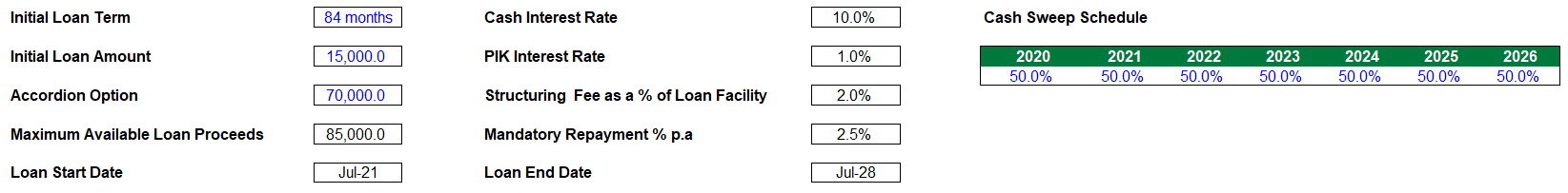

The major hurdles faced by the TresVista team were incorporating a prolonged deal execution timeline, resulting in numerous reconciliations of the historicals every month, building complex dynamic formulas for the acquisition schedule, and understanding the terms and different securities in the term sheet.

The TresVista team overcame these hurdles by communicating with the client to understand mapping as well as the minute details of the deal in a better manner. The team also studied news articles and research reports from various sources to gain more insight into the industry/company.

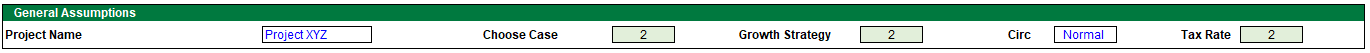

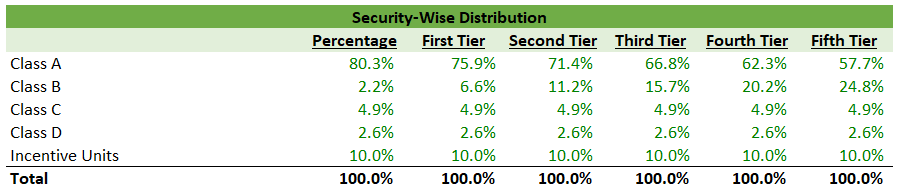

The TresVista team provided switches for growth strategy, tax rates, and different assumptions for a more detailed understanding and analysis of the future growth and forecast of the company. The team provided the client with questions they can ask the management of the company in which they invest. Since many acquisitions were supposed to occur, the team prepared multiple debt financing options such as revolving credit, term loan facility, and delayed term loan facility with the industry interest rates with optional pre-payment premium.