The client, a Private Equity firm, wanted the TresVista team to prepare a quarterly review of the client’s portfolio, which would help the client analyze the current and forecasted performance of the portfolio.

To build a streamlined process for quarterly portfolio monitoring and reporting and assist the client manage the complex nature of deals.

The TresVista team followed the following process:

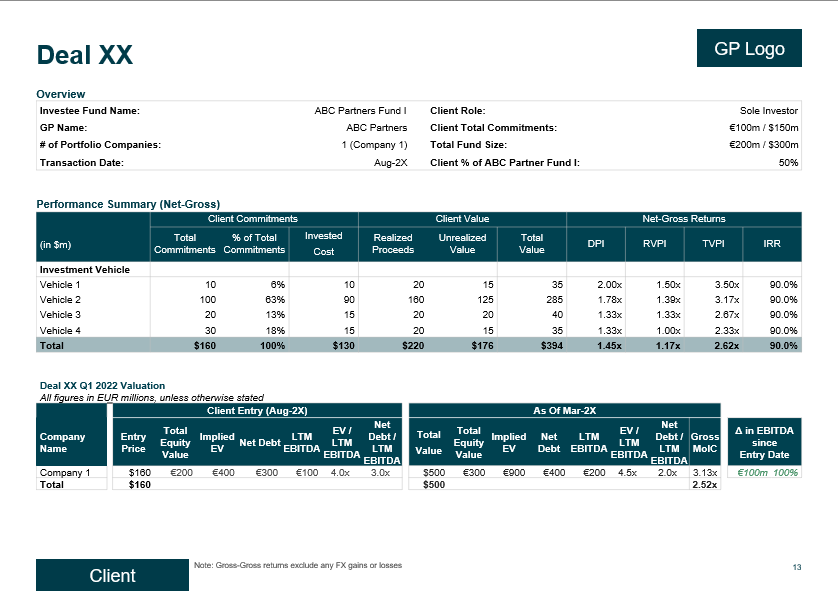

Consolidation of Data: Consolidated and analyzed all the asset-level metrics to understand the performance of all the companies in each deal.

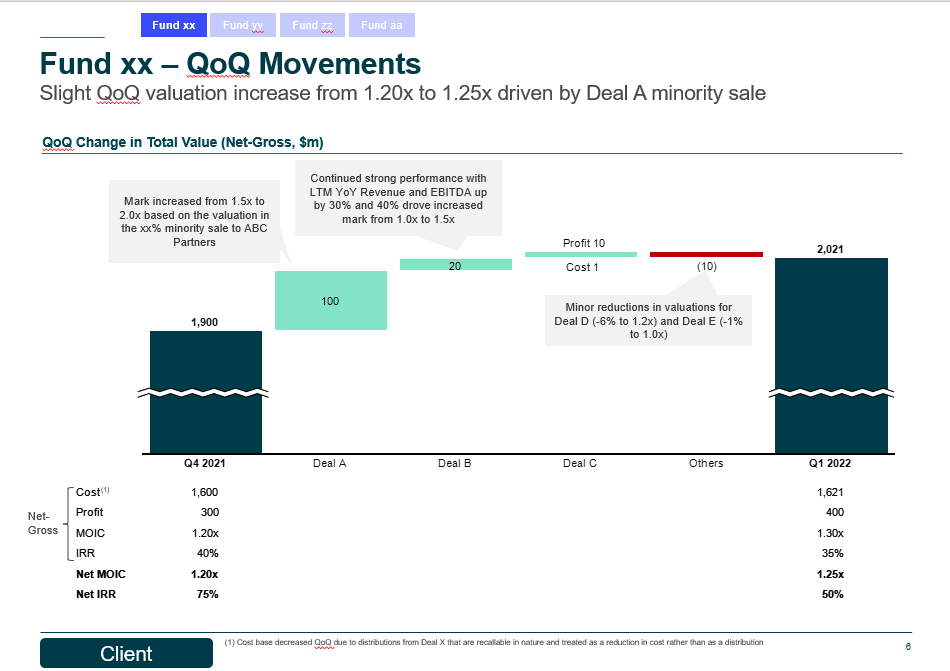

Integration with Client CRM & Valuations: Captured all the data in the CRM, validated the consolidated and analyzed data, and represented performance and valuation for all the deals.

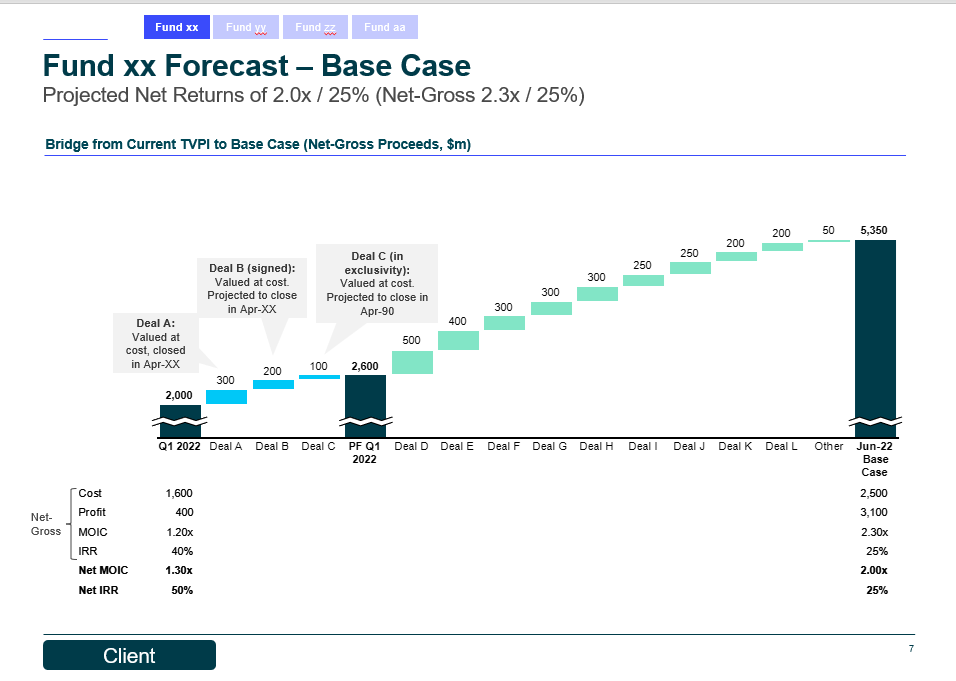

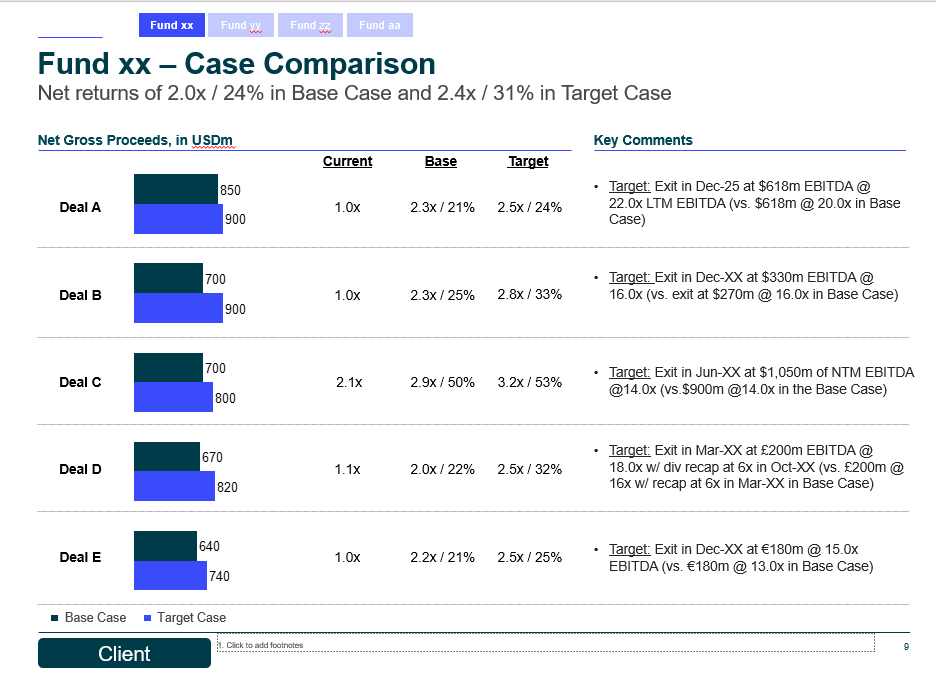

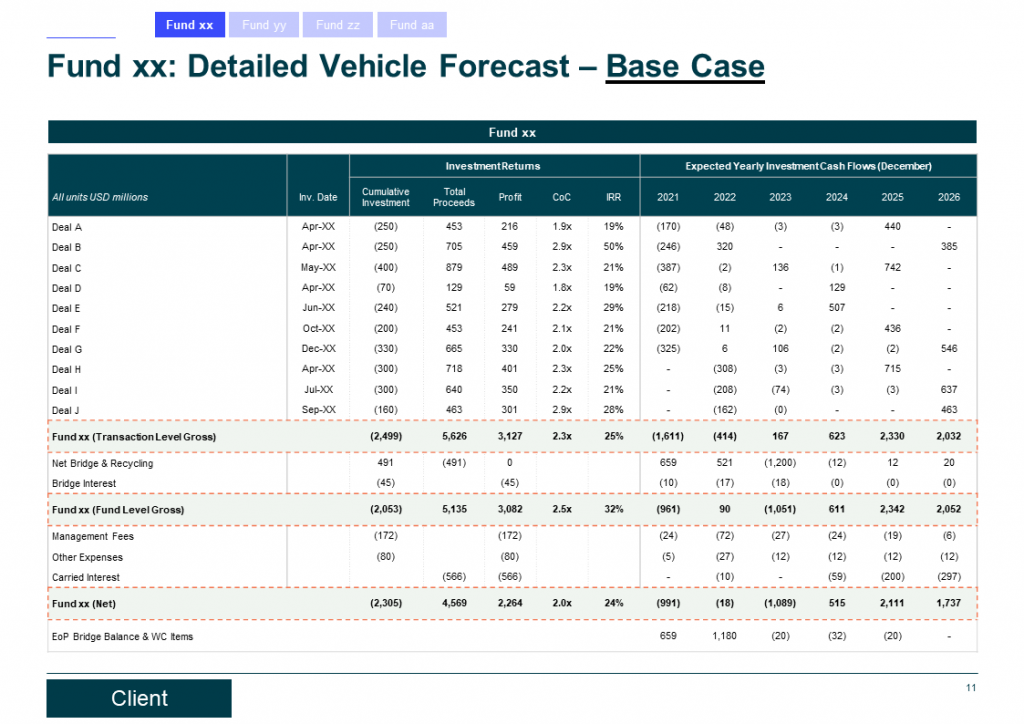

Reforecasts and Report Preparation: Integrated the fund models into the QPR and analyzed the forecasted cash flows and liquidity profile for all the funds to prepare the QPR deck that displays fund-wise current and forecasted performance.

The major hurdles faced by the TresVista team were integrating data from different departments/deal terms from the client’s side, ensuring the comments/data from every stakeholder from the previous as well as the current quarter are incorporated in the QPR, data inconsistencies across the client’s External report and GP reports.

The TresVista team overcame these hurdles by ensuring that the data across the different sources were consistent with each other, by effectively and proactively communicating with the client, and by automating the process to reduce the amount of manual work required and the probability of errors.

The TresVista team acted as a centralized source to take care of the requirement of every stakeholder involved from the client’s side in the QPR process, ensured consistency and accuracy in the representation of data across multiple sources, and provided a high level of automation in the QPR process which saved a significant amount of time and reduced the probability for errors.