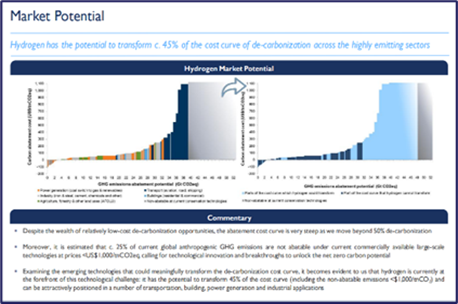

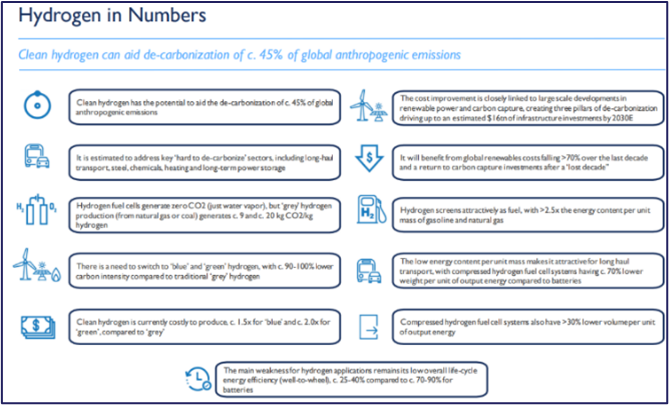

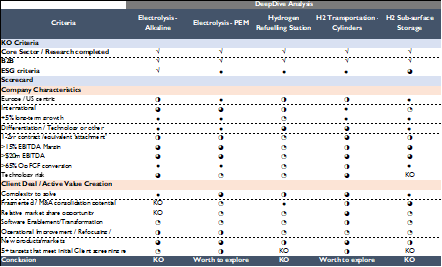

The client, a Private Equity firm, wanted the TresVista team to analyze the Hydrogen industry and prepare a detailed analysis paper as they were looking at a potential acquisition in this sector. This involved preparing a scorecard for initial screening on sector/subsector/targets based on the screening criteria provided by the client and spreading trading comparable for the top-performing companies in each segment of the sector. The sector analysis paper formed an integral part of the investment thesis and was to be shared with the LPs along with the thesis.

To create a detailed sector analysis paper to assist the client in having a better understanding of the sector for a potential acquisition.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

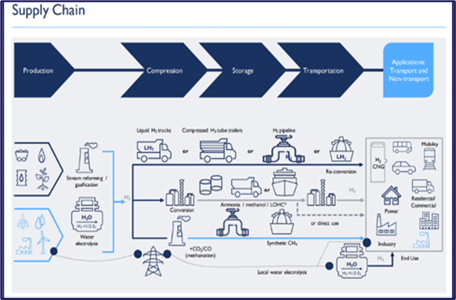

The TresVista team overcame these hurdles by using dated market segmentation data as a basis and pro-rated the latest market size data to derive segmental data as per the client’s requirement. Where data was available at the sub-segment level, the team derived the overall segment size by adding up the sizes of sub-segments. The team used a wider approach and considered broader players where direct market players were unavailable for the niche segments. The challenge regarding subjectivity in company selection was addressed by communicating our approach to the client.

The TresVista team created a scorecard that gave the client a preview of the industry helping them to decide whether to go forward with the research or not. Additionally, the division of the task into sub-parts facilitated enhanced research and improved knowledge. Players in individual segments were identified via supply chain mapping and a breakdown of the value chain was provided as well. The sector paper was divided into Macro and Micro sections, which helped the client analyze the industry and understand the detailed competitive landscape and supply chain position of the company.