The client, a US based Private Equity firm that focuses on investing in high growth businesses in the lower middle market, needed the TresVista team to understand the rationale for the fall in sales volume of one of its portfolio companies. The client provided TresVista with a data dump and wanted the team to perform a set of analyses that could help them solve this problem. The team was also asked to evaluate a potential add-on acquisition for the company.

To conduct a detailed analysis to understand the rationale for the fall in sales volume, along with further evaluation of a potential add-on acquisition.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

To overcome the hurdles faced, the team spent additional time in researching about the industry to understand the companies better and provide a more comprehensive analysis.

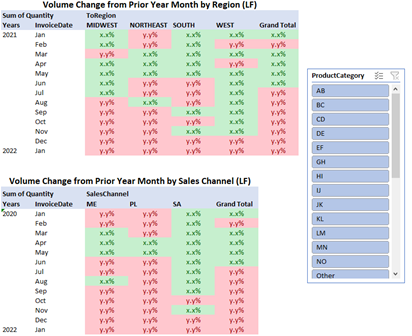

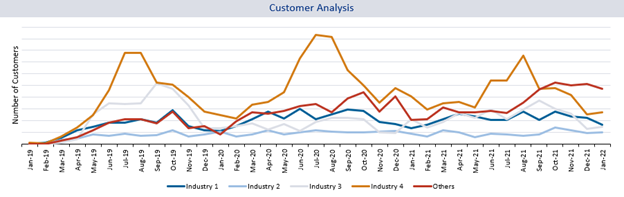

Apart from the revenue and volume by product and channel analysis requested by the client, the team also provided a customer churn and retention analysis that helped derive the conclusion that while the company is successfully retaining its client base, it is struggling to find new customers. The team also prepared a geographical analysis showing the regions that were contributing the most to the downfall and put together a customer analysis presenting the key industries that faced decline in the number of customers.