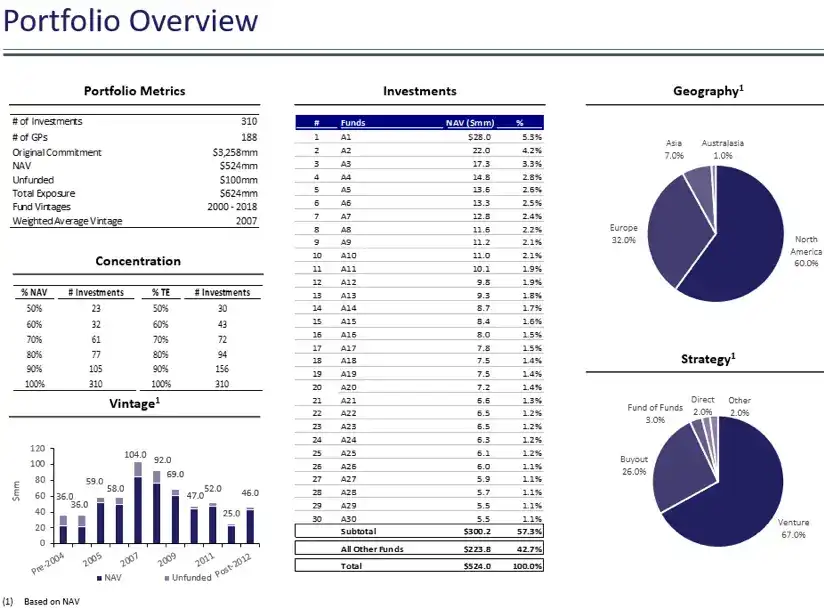

The client, a secondaries investment advisor, was approached by a U.S. based middle-market fund-of-funds manager to evaluate the sale of a mature portfolio. Post signing the engagement letter, the client requested their TresVista Team to join the deal team and participate in all stages of the process.

The TresVista Team discussed the seller’s objectives to better understand the process – maximizing price and offering a liquidity option for the existing LPs in the 28 mature products and optimizing administration costs.

To provide deal assistance on the sale of a highly diversified portfolio which included 310 funds.

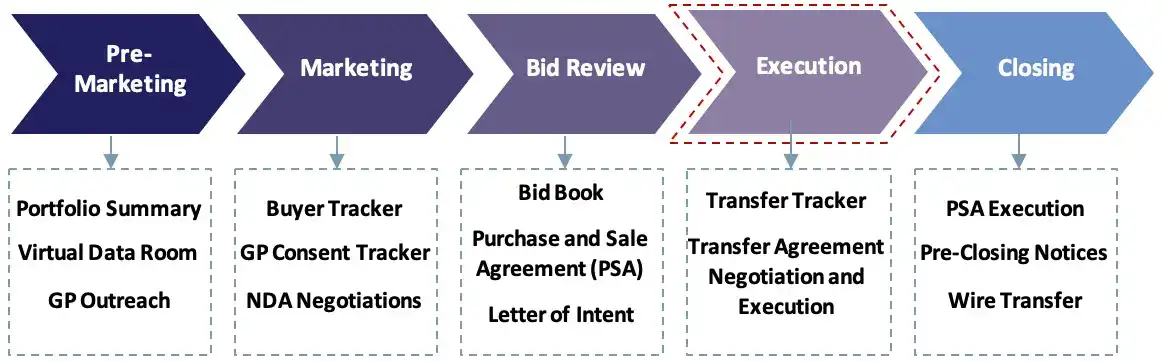

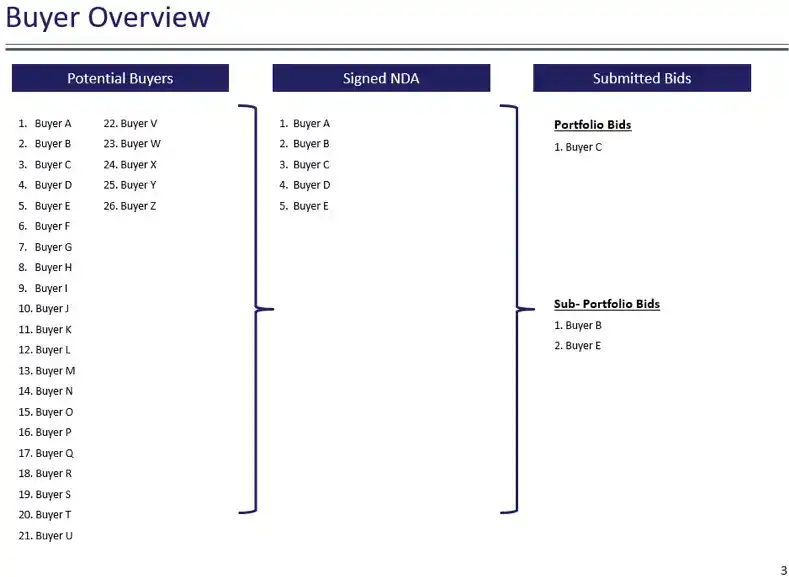

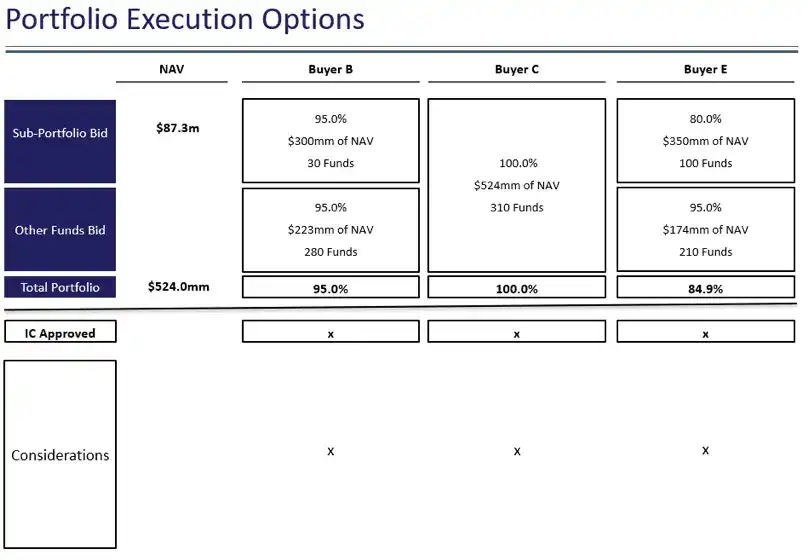

The TresVista Team provided support to the client throughout the transaction process:

The TresVista Team encountered the following hurdles:

The TresVista Team would connect with the clients’ New York team and brainstorm on how to make processes more efficient and save duplication of effort. Much of the heavy lifting was done by the TresVista Team in the pre-marketing phase which resulted in more bandwidth at the client’s end and allowing them to focus more time on business development efforts and strategic initiatives.