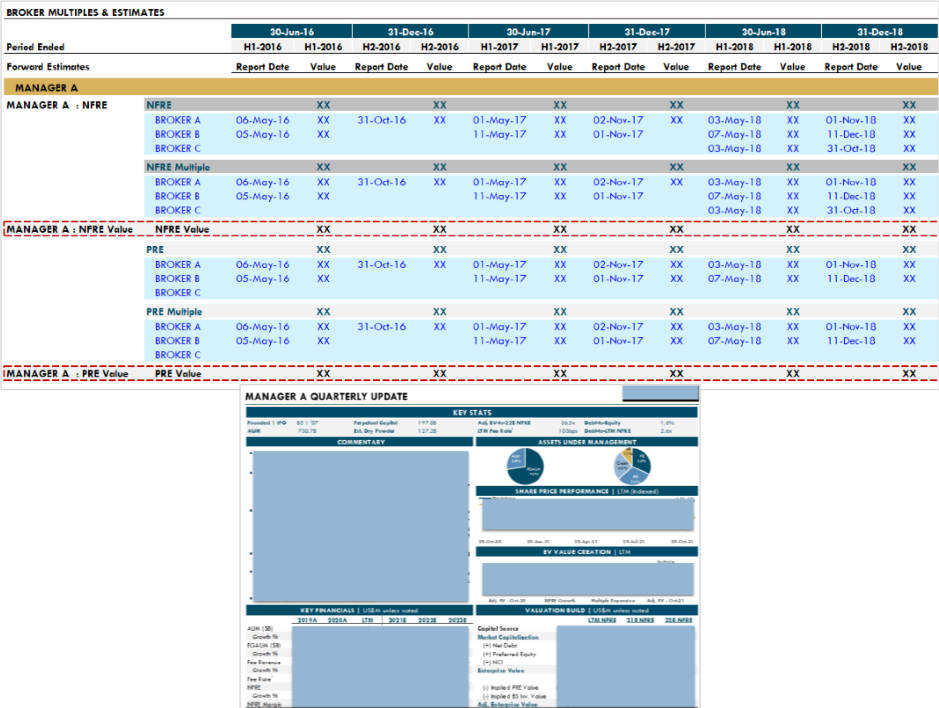

The client, a Secondary Private Equity firm, wanted to benchmark themselves against the industry experts and gain insight on the potential additional revenue streams. The client wanted the TresVista Team to track the performance of some of the top publicly listed asset managers (PAM) around the globe, including coverage around broker valuation and estimates for the same. The goal was to come up with a process to track the performances of these managers and standardize the numbers in a way that they are comparable to the client’s business model.

To track the performances of publicly listed asset managers and run a comparative analysis to assist with client benchmarking.

The TresVista Team followed the following process:

The major hurdles faced by the TresVista Team were:

The TresVista Team overcame these hurdles by analyzing the large public asset managers because they were well covered, and their data was widely available. The team decided to conduct their own valuations based on the forecasted analysis to standardize the valuation methodology. The team carried out extensive discussions with the client and looked through operating models obtained from the brokers to homogenize the nomenclature and meaning of the metrics. The team leveraged the historical margins for each revenue type to segment incomes where segmentation was not available.

The TresVista Team helped the client with data room management. The team also studied historical expense margins to develop an average case that could be used to apportion the revenue items where expense segmentation was not available.