The client, a Wealth Manager, based out of the U.S., wanted to build a thesis around assets that are uncorrelated to market performance. The industries with no (as opposed to negative) correlation to broader equity markets were also to be considered. They were looking for industries to invest in to diversify their portfolio. They wanted the TresVista Team to conduct research and provide a broad overview of all possible uncorrelated assets that could be included in the client’s strategy.

To conduct research and provide a broad overview of all possible uncorrelated assets that could be included in the client’s strategy.

The TresVista Team followed the following process:

The major hurdles faced by the TresVista Team were the lack of availability of data around the correlation coefficient of the industries and the relevant market data for the industry. The team overcame these hurdles by following a thorough top-down approach. They reviewed government and company press releases, scholarly articles, and podcasts and collated the latest relevant market data and correlation coefficient.

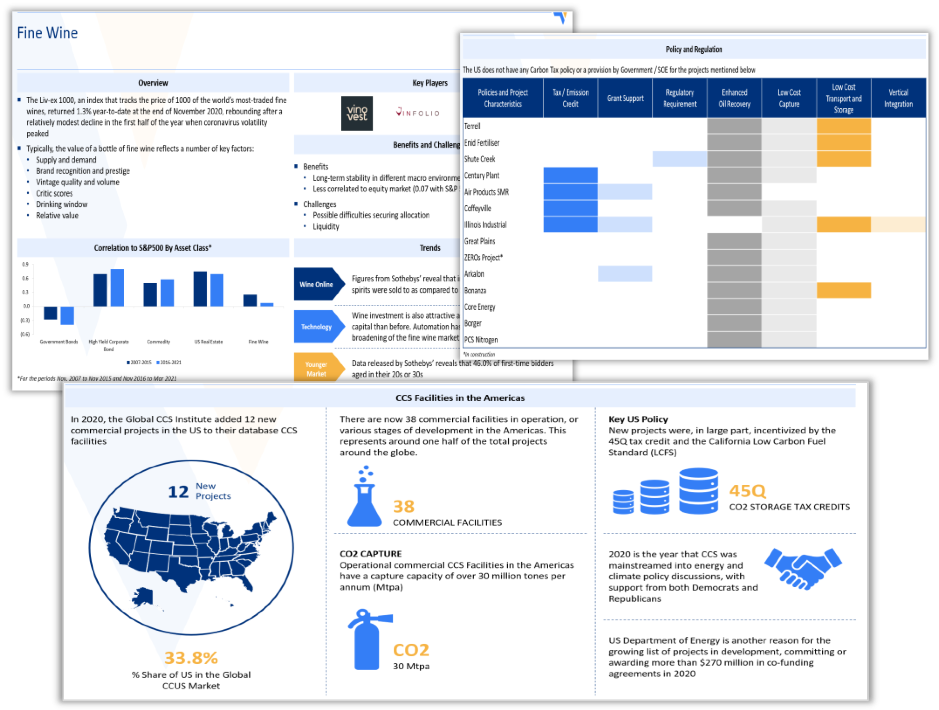

The TresVista Team went beyond the traditional research methods and reviewed podcasts to collate industries that fit the client’s requirements and strategy. Post the initial output, the team followed up with the client and showcased the potential growth of carbon as an asset class by creating an infographic. The team also provided a detailed overview of the CCUS industry and the future of carbon as an investable asset class.