The client, an Impact Investing firm wanted the TresVista team to provide updates on all the companies in the comps set to analyze, keep track of the performance of its portfolio company, and identify internal opportunities for improvement. They also wanted the list of peer companies that they wanted to include in the benchmarking process and a few metrics that they wanted to track while also giving the team the freedom to include any other relevant metrics.

To analyze and track the performance of portfolio companies in comparison to their peers.

The TresVista team followed the following process:

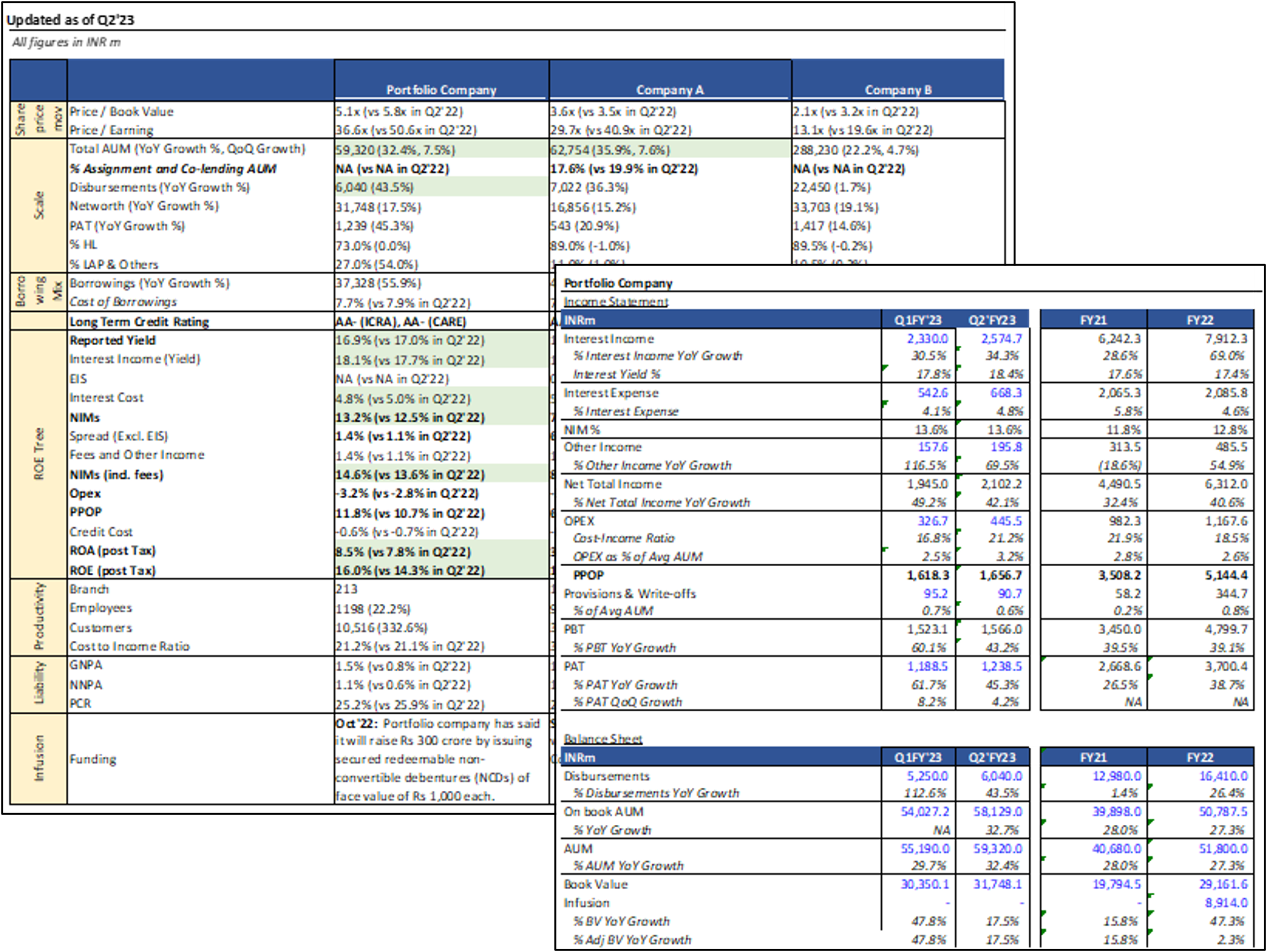

• Creation of Individual Company Tabs: Created individual company tabs for the portfolio company and its peers to capture their performance

• Creation of a Summary Tab: Created a summary tab to capture the important metrics and automized it by using concatenate function

• Data Sourcing: Gathered the latest investor presentation, financial statements, and conference call transcripts for the peer set

• Data Input and Calculation of the Important Metrics: Populated the required parameters from the data sourced and calculated the important metrics

• Performance Analysis: Analyzed the performance of the portfolio company in comparison to its peers

The major hurdles faced by the TresVista team were to analyze a huge amount of data on various business-related aspects with each company having its definition of the parameters and the time constraint, as the benchmarking was required to be updated along with other quarterly updates, deal-related exercises, and other ad-hoc deliverables.

The TresVista team optimized and saved the client’s time by providing a complete analysis by streamlining the summary tab along with observations. The team also prepared a quarterly presentation update indicating the relative performance of all the companies for the client’s board presentation.