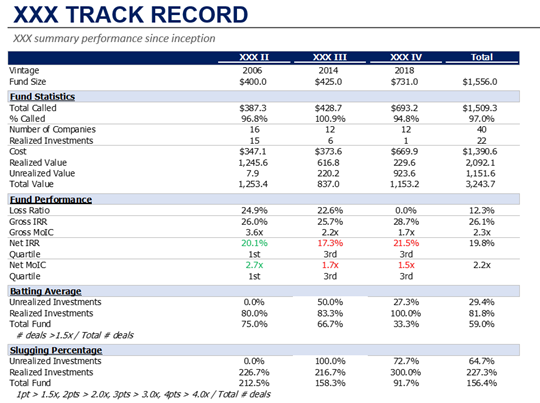

The client, a Family Office, asked the TresVista team to build a detailed track record analysis of the private equity firms’ past funds with the same strategy (predecessor funds). The request was recurring in nature and was a part of the client’s diligence process when evaluating potential private equity fund investments.

To build a detailed track record analysis of the private equity firms’ past funds.

The TresVista team followed the following process:

• The first step for this request was to enter all the information in the input tabs

• Ran a sense check at the individual portco and fund level to match the IRR and MoIC values calculated in the excel file vs. the IRR and MoIC values in the GP materials

• After finalizing the input tabs, the team started working on the output tabs which were already automated and required only small adjustments from the team’s part

• Once the adjustments were made, the team started to take snips from the output slides and pasted them in the PPT

The major hurdles faced by the TresVista team were:

• Sanitizing cash flow entries: There are two broad types of cash flows in private equity funds – capital calls and distributions. However, there are cash flows altering previous cash flows such as return of capital (i.e., reverse capital call), withholding of distribution for tax purposes, etc. In order to account for these situations, the team had to sanitize the cash flows entries on a portco and fund level

• Information overload: Data rooms for fund diligence usually consist of over 100 files, consisting of various regulatory documents (PPM, DDQ, Form ADV) and other financial and operating information. Navigating through this data room to find the specific information for the request was a challenge

• Fixing formulas and calculations: There are cases where the formulas to automate the outputs, or formulas to calculate various metrics might result in errors or do not show the desired outputs – in these cases, the team altered the formulas or create new formulas, after discussing with the client

The team overcame these hurdles by implementing sense checks at every step, and through practice and experience. After completing a few quant analysis, the team had a better understanding of the template that the client uses and of the desired outputs. Whenever the team faced an issue with any formula or any computation, they flagged it to the client over email and discussed it over their weekly calls.

The TresVista team provided qualitative commentary on the quant analysis and interesting observations that might affect the investment decision. The team helped build on the established template of the quant analysis with new ideas and altered outputs/formulas which were resulting in errors.