The client, a Private Equity firm, asked the TresVista team to restructure a workbook to bring in more efficiency and simplicity in the excel based accounting model for importing local accounting data of nine overseas subsidiaries into the client’s central accounting software. The team was also asked to reconcile the YTD P/L differences which arose while importing the data

To restructure the workbook for ease of importing the data and reconcile YTD P/L differences.

The TresVista team followed the following process:

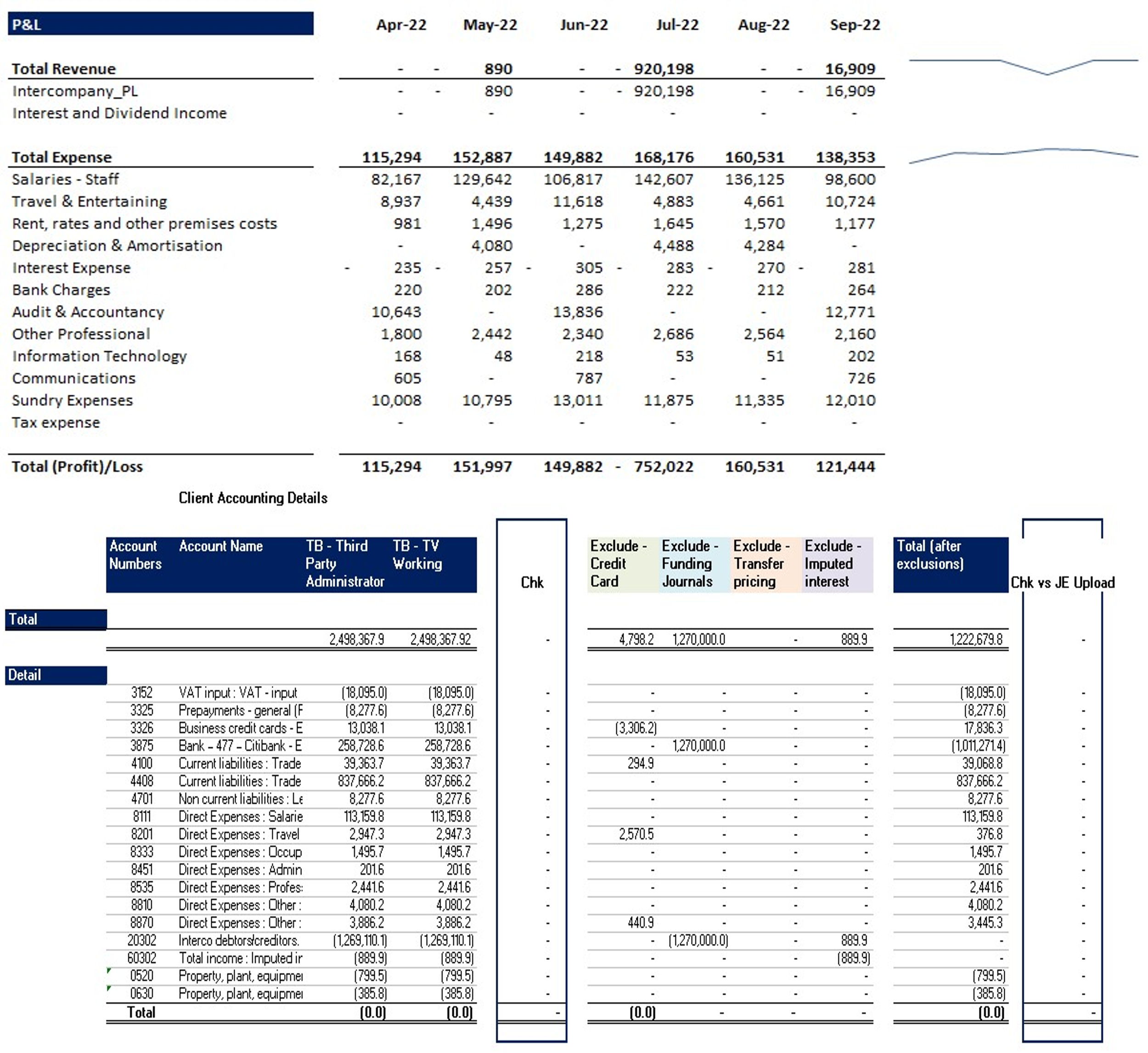

• Automation: Created a standardized accounting excel workbook for each subsidiary

• Establishing checks: Created an account level reconciliation tab to identify any variance in postings and prepared checks for individual tabs to ensure completeness in the transfer of TPA data to the working file

• Variance Analysis: Analyzed the monthly trend in costs (Salaries, Bonus, Depreciation) booked for each subsidiary and investigated the reason for variance

• Reconciliation: Identified and investigated the differences in account balances as per the Trial balance of local TPA with Trial Balance from client’s accounting software after completion of monthly postings

The major hurdles faced by the TresVista team were:

• Different formats of local data and incomplete information received from the TPA (Ex: vendor names, incomplete memos, data in local language)

• Different accounting standards lead to different accounting treatments of certain items

• Late accounting adjustments were not communicated by the TPA, and entries posted by different teams of the client centrally were not communicated to the team or the TPA

The team overcame these hurdles by reaching out to the TPAs, asking them for certain specific changes in the formats to standardize the workbook for all the subsidiaries. The team also reach out to process owners to understand the entries and communicate the entries to the TPAs along with the accounting logic to resolve the differences. In certain cases, such as lease accounting, certain differences were categorized as permanent differences in the reconciliation file due to different accounting standard being followed by the local TPA and the client centrally, where rent was treated as a P/L expense by the TPA whereas it was treated as a lease liability payment by the client centrally.

The Tresvista team automated the Subsidiary Accounting workbook reducing manual work, making the process efficient and less time-consuming. In addition to automation a detailed audit trail by categorization of workings and checks, TPA documents, Support Database was created in the monthly postings files to reduce time required to gather TPA data whenever required. The TresVista team functioned as bridge between the client’s group finance accounting team and the local TPAs of the overseas subsidiaries and helped resolve the communication gap which helped the client resolve the YTD reconciliation differences before the Year End audit. Additionally, communication of Transfer Pricing calculations to the local TPA was simplified to avoid future differences in the Transfer Pricing line items.