We use cookies on our website to help you navigate efficiently and perform certain functions. A Cookie is a small piece of data (text file) stored on your computer or mobile device by your web browser. We may use Cookies to personalize the content that you see on our Website and to identify the areas of our Website that you have visited.Those cookies are set by us and called first-party cookies. We also use third-party cookies that help us analyze how you use this website, store your preferences, and provide the content and advertisements that are relevant to you and aide our marketing efforts. Most web browsers can be set to disable the use of Cookies. However, if you disable Cookies, you may not be able to access functionality on our Website correctly or at all.

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

In addition to cookies, some information may automatically be collected as you browse our Website, such as type of browser, operating system, domain name or IP address.

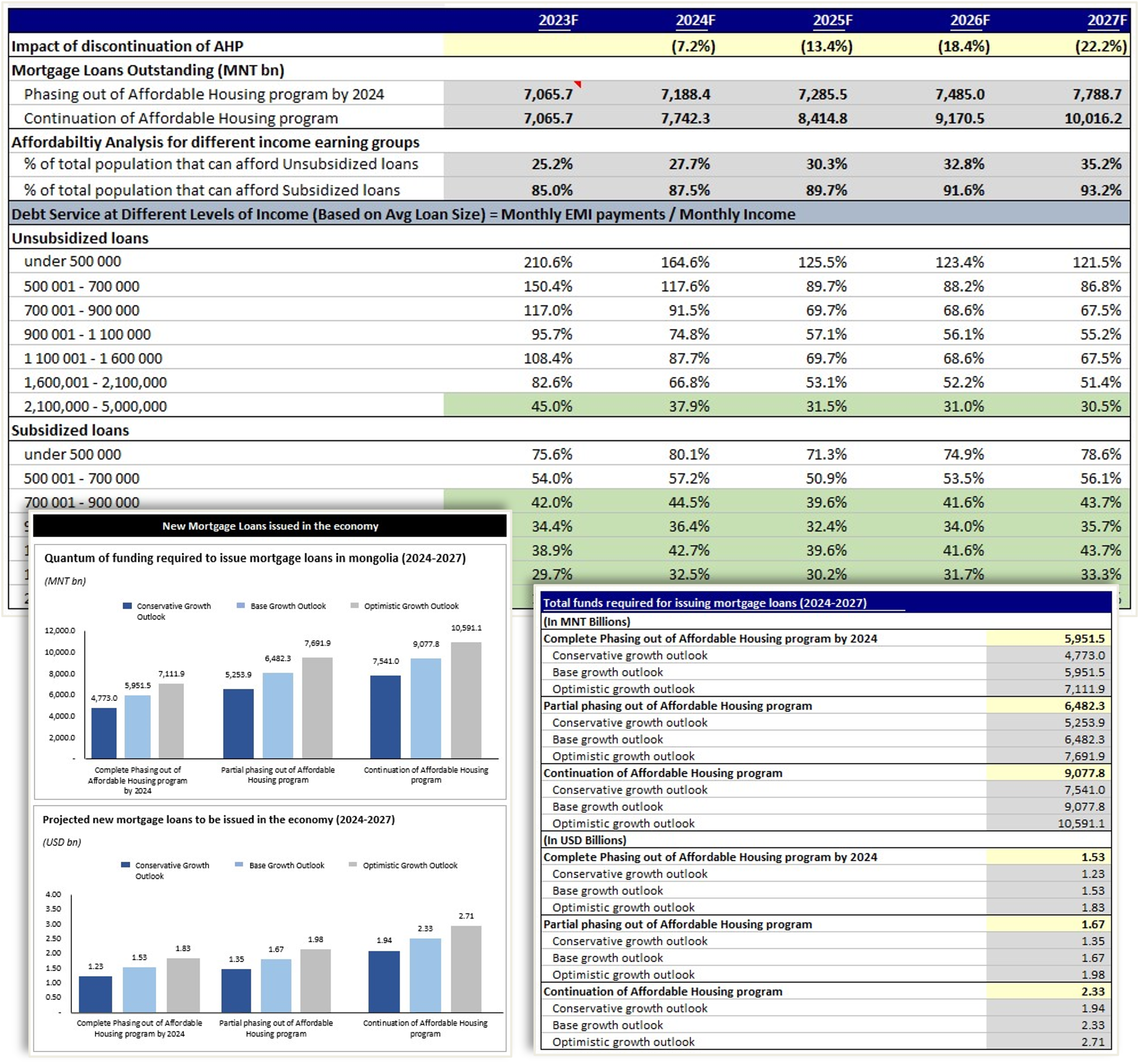

The client, an Investment Bank, asked the TresVista team to forecast the mortgage loans outstanding in Mongolia for five years and calculate the additional funding that would be required after the discontinuation of a popular subsidized mortgage program run by the Government of Mongolia. The request also included identifying and analyzing demographic factors that would lead to future mortgage growth in Mongolia. The client also asked to create a memorandum in Word and Powerpoint which presents the findings which can be useful for convincing Mongolian banks to raise funding from international financial institutions for mortgage lending.

To analyze the mortgage market in Mongolia and check if the market needed any additional funding

The TresVista team followed the following process:

• Forecasted mortgage loans outstanding using regression analysis and mortgage depth analysis

• Regression analysis to forecast the mortgage loans outstanding was run using the number of borrowers and Housing Price Index as independent variables

• Performed mortgage depth analysis to calculate the mortgage loans outstanding as a % of GDP for Mongolia’s economic peers with the assumption that Mongolia’s mortgage market would grow to reach its peer group levels

• Considered the impact of the discontinuation of Mongolia’s Affordable Housing Program using an affordability analysis to arrive at the final amount of loans that would need to be issued

• Presented the findings in a memorandum along with excel and word backups

The major hurdles faced by the TresVista team were:

• Data on mortgages was not available for a few of Mongolia’s economic peers which limited the choice of economic peers in the mortgage depth analysis

• Lack of historical data points on housing and demographic statistics resulted in the creation of a less detailed linear regression model than anticipated

• Difficulty in ascertaining the exact impact of discontinuation of Affordable Housing Program due to high interest rate differential between mortgages issued by banks and the government’s housing program

The team overcame these hurdles by reaching out to the client, who in turn reached out to a few local parties. But the information required was still not available. Once all the sources were exhausted, it was decided to proceed with the available data. With regards to the economic peer analysis, the search parameters were widened and included a few additional peers and a few advanced economies. The affordability of mortgages at various income levels in Mongolia was investigated and percentage of the population that would not be able to afford loans after the discontinuation of the Affordable Housing Program was also calculated.

The TresVista team created a memorandum that the client could use in convincing local banks to raise funds that could be deployed in the mortgage markets. All the projections with regards to mortgage issuance and mortgage loans outstanding included in the memorandum were forecasted by the team. The team also ran an analysis of the factors resulting in the mortgage market growth in Mongolia which would help the client convince local banks to raise funds.