Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

How we helped a Hedge Fund in analyzing the overall sentiment of the market by studying a particular statement provided

The Context

The client, a Hedge Fund, asked the TresVista team to assess the market sentiment from unstructured secondary sources and gauge the probable impact of prevailing sentiment on the market. The team familiarized themselves with Risk-on & Risk-off concepts for asset classes; understand various risk-inherent assets, return, monetary/economic policy, etc. Additionally, the client requested to apply the above understandings in the context of developed and emerging markets’ economic conditions to derive a necessary judgement.

The Objective

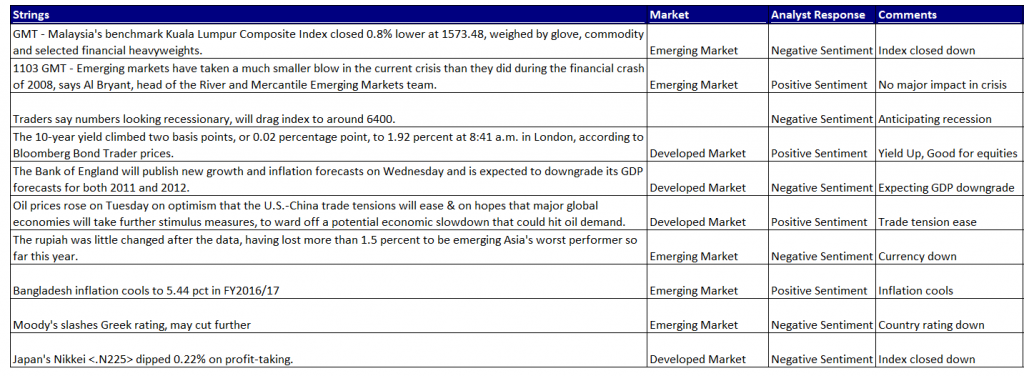

To capture whether a financial statement/sentence contains positive or negative sentiment toward the economy

The Approach

The TresVista team followed the following process:

• Macro/Micro: Identified whether the statement is Macroeconomic and not company-specific statements

• Asset Class: Understood which asset class the statement is referring to

• EM/DM: Ascertained whether the statement belongs to Emerging / Developed Markets

• Final labelling: Evaluated and derived the correlation between the asset classes and weighed the consequences on the economy and further labelled it

The Challenges We Overcame

The major hurdle faced by the team was the subjective nature of the task which was due to differences in the responses of team members. Additionally, analyzing complex/technical statements which were difficult to outweigh as positive/negative/neutral and opinion-based statements by economists were also the obstacles faced by the team.

The team overcame these hurdles by having an in-depth understanding of the macroeconomic indicators like market index, fixed income securities, GDP, inflation, currencies, commodities etc. The team was trained and got clarity on basic concepts to reduce subjective responses. The team also asked for feedback from the client on complex, technical and boilerplate statements and followed the correct approach.

Final Product

The Value Add – Catalyzing the Client’s Impact

The team structured the overall process and drafted a detailed SOP by inculcating their understandings gained through executing the first iteration of the project. The team also provided a quick turnaround for this project. The quality of work was well appreciated by the client and helped the team to bag more complex iterations of this project.