How we helped a Vegetation Management client to analyze Lease Agreements of the clients and create Amortization Schedules

The Context

The client, a Vegetation Management firm, asked the TresVista team to analyze lease agreements of the clients and make a note of vital information including lease term, monthly payment, residual value, and ownership transfer/ bargain purchase offer. The TresVista team was to determine whether the lease is a finance lease, or an operating lease based on the given information and create amortization schedules.

The Objective

To analyze lease agreements of the client and reconcile the balance sheet values for the lease liability and the ROU asset.

The Approach

The TresVista team followed the following process:

• Data Screening – Analyzed the lease agreements and determined all important relevant information

• Data Consolidation – Created a consolidated database of all leases based on their unique identification number. The database consisted of all the relevant information that the clients were looking for

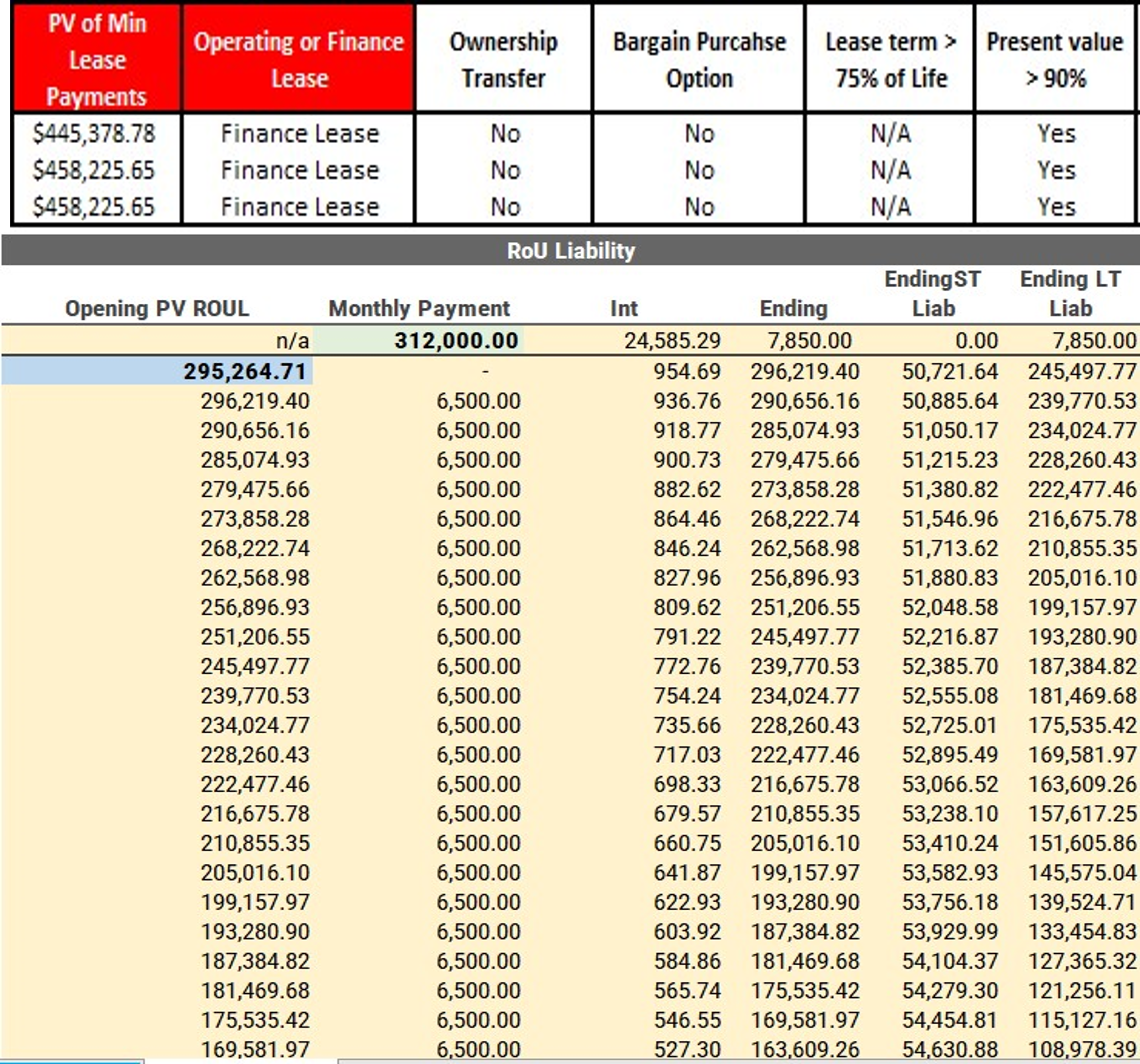

• Data Synthesis – Calculated the present value of all future lease payments, which was used to determine whether the lease is a finance lease or an operating lease

• Lease Schedule – Calculated the interest payments and principal repayments for the lease liability as well as the periodic amortization of the ROU and created a schedule for each lease

• Balance Sheet Reconciliation – Using the lease schedule that was created the team reconciled the values of the ROU asset and the lease liability on the balance sheet for each reporting period

The Challenges We Overcame

The major hurdles faced by the TresVista team were:

• The client had poor data management with significant details missing in their database

◦ The hurdle was made worse by the fact that the TresVista team had to analyze 500+ lease agreements to note down all important information

• To coordinate with the company management and their lessors daily to ensure uniform understanding of the contract terms and language

The team overcame these hurdles by having a daily meeting with the stakeholders of the project and constantly communicated the issues that were faced. These issues were solved internally by the clients and their lessors, which helped in building a consolidated database that consisted of all the relevant information that the clients were interested in.

Final Product

The Value Add – Catalyzing the Client’s Impact

The TresVista team created a standardized template to record all key data points related to the lease agreements. Through the information in the database the lease schedule was created where the interest payment, the principal repayment and the periodic amortization expense were calculated. Hence, the database helped in eliminating time consuming repetitive steps. The team also provided the clients with a calculation of the short-term liability and the long-term liability for each lease throughout the lease term.