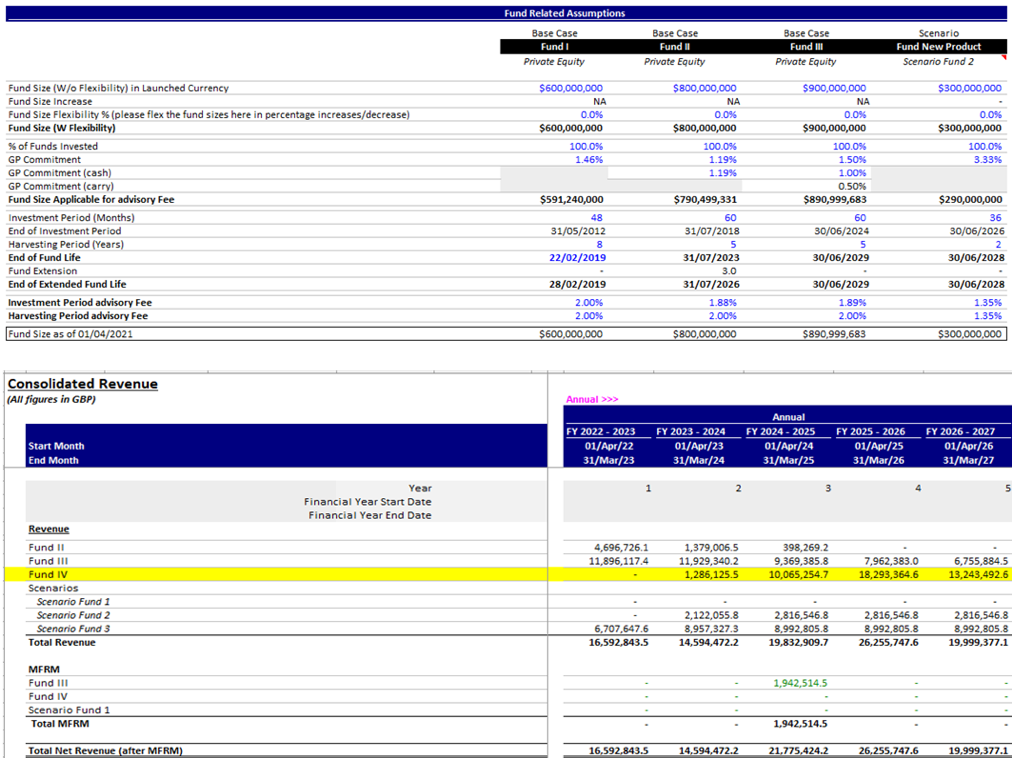

The client, a Private Equity firm, wanted the TresVista Team to prepare a 5-year Fund Budget Model as a part of the client’s annual budget approval plan, to track the current and future performance of the fund. The client asked the team to build revenue flows for new funds and update the revenue recognition for the closed and present funds. Additionally, the client wanted the team to model the recycling of company assets from older funds to newer funds. The team was also asked to enable scenario testing for fund extension, fund close dates, fund size, etc.

To update the client’s annual fund budget model to track the current and future performance of the fund.

The TresVista Team followed the following process:

The major hurdles faced by the TresVista Team were:

The TresVista Team overcame these hurdles by conducting frequent meetings with the client to understand the problem and identify the client’s goal for each section.

The TresVista Team provided the client with a budget model which was automated, allowed for flexibility to run for different combinations of scenarios, and provided summaries for better presentation and analysis for the client.