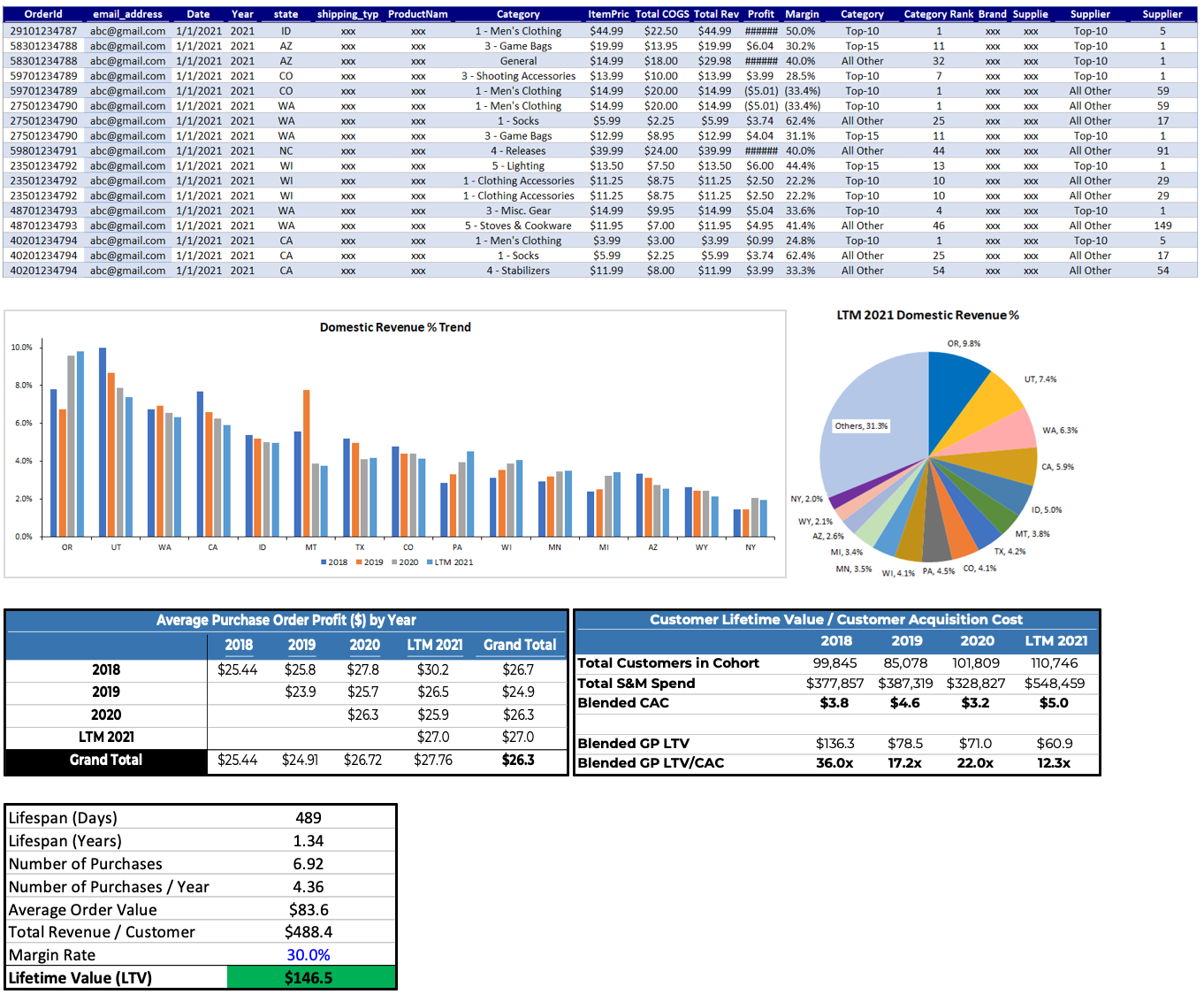

The client, a Private Equity firm, wanted the TresVista team to consolidate and clean up the raw fragmented data provided by an E-commerce hunting private company, and to perform the financial data analysis. The client also wanted the team to utilize the customer data to find the Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) for the company. Finally, the team was asked by the client to provide outputs in the form of charts to be incorporated in the Investment Committee Memorandum (IC-Memo).

To convert the raw unfiltered data into summary sheets to gauge the revenue bifurcation based on different criteria, incorporate them into the investment deck in the form of visuals (charts, graphs, tables) and calculate CLV and CAC.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

The TresVista team overcame these hurdles by converting the entire data set from range into tables, filtering out outliers and negative entries, and populating the missing data from reference files.

The TresVista Team helped provide insights on the financial and customer data of the target company and the client got clarity about a potential turn-around opportunity by optimizing the supply chain and improving the sales and marketing operations after the acquisition.