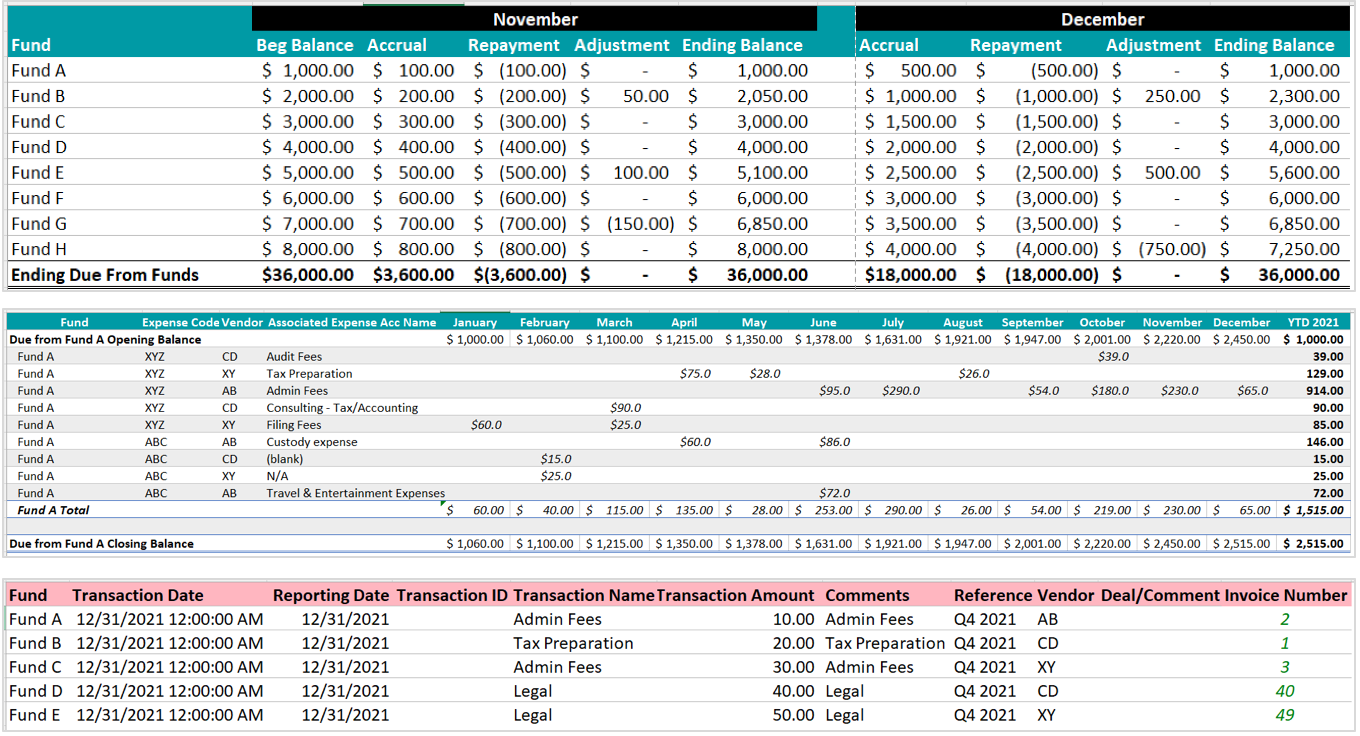

The client, a Private Equity firm, wanted the TresVista team to prepare a monthly report tracking all the intercompany transactions made by the management company (advisors) on behalf of various funds/entities. This report would then be leveraged to communicate the intercompany transactions to the fund administrator every quarter.

To have a systematic process in place to communicate all the intercompany transactions to the fund administrator to make sure all the receivables are duly accounted for, on the fund’s side as well in their books.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

The TresVista team overcame these hurdles by preparing an excel tracker to highlight the entity-fund relationship and updating the same on an ongoing basis. Moreover, the team started saving all the relevant invoices related to the intercompany transactions, which were to be utilized at the time of preparing the report. Finally, the team performed a historical clean-up to align the fund and advisor’s ending balances.

The TresVista team provided a summarized view of the monthly intercompany activities so that the client could get an overall understanding without having to go through the voluminous GL data. The team cleaned the complete accounting data in the GL to align them with the fund’s books and reviewed the bookings for all the receivables against the entities and funds. Further, the team streamlined the process of communicating the receivables to the fund administrators in the TNR format. The team also determined the quarterly repayment amounts and prepared relevant repayment entries once they were deposited.