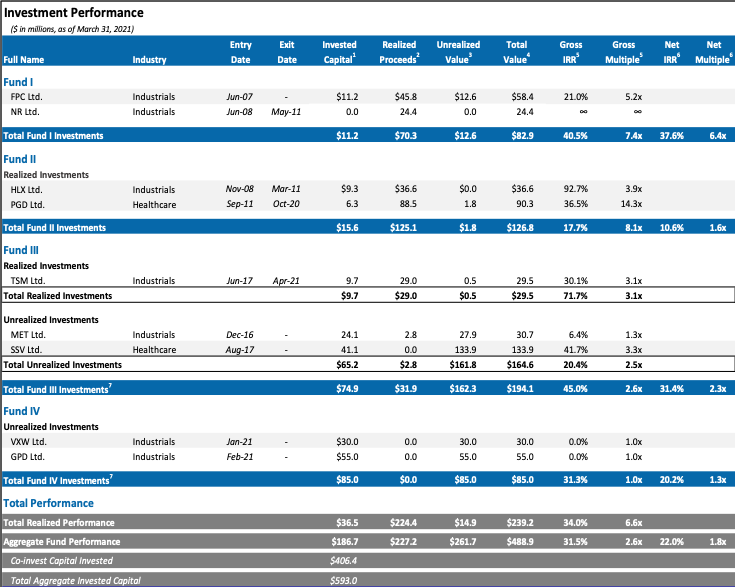

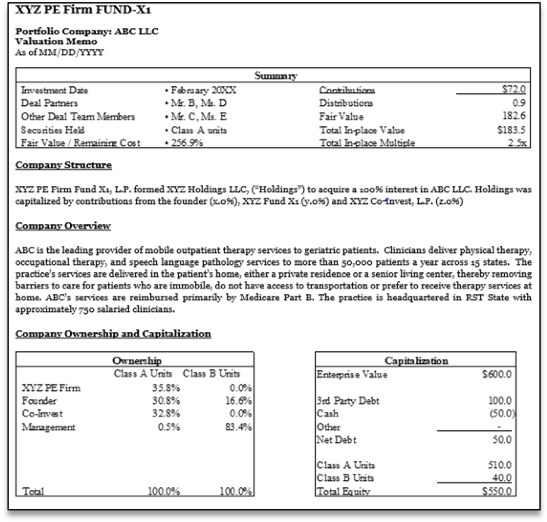

The client, a Private Equity firm, wanted the TresVista Team to assist them in the quarterly portfolio reporting process, which required conducting analyses and tracking the performances of the portfolio companies. The team helped facilitate the maintenance and updates of all the records related to the valuations of the portfolio companies.

To update and maintain the portfolio companies’ valuation models and consolidate the information into a valuation tracker.

The TresVista Team followed the following approach:

The major hurdles faced by the TresVista Team were the latency in the attainment of input files because of the involvement of multiple sources and continuous iterations in the valuation process, which led to the repetition of the primary task. The TresVista Team overcame these hurdles by keeping all the valuation files ready and rolled forward in advance so that only the current values required an update. The team was constantly communicating with the client to ensure that the valuation numbers were up to date.

The TresVista Team enhanced the performance analysis process by including various analyses such as segmentation of portfolio companies, trend analysis, and reporting deviations in the actual and budgeted values.