Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

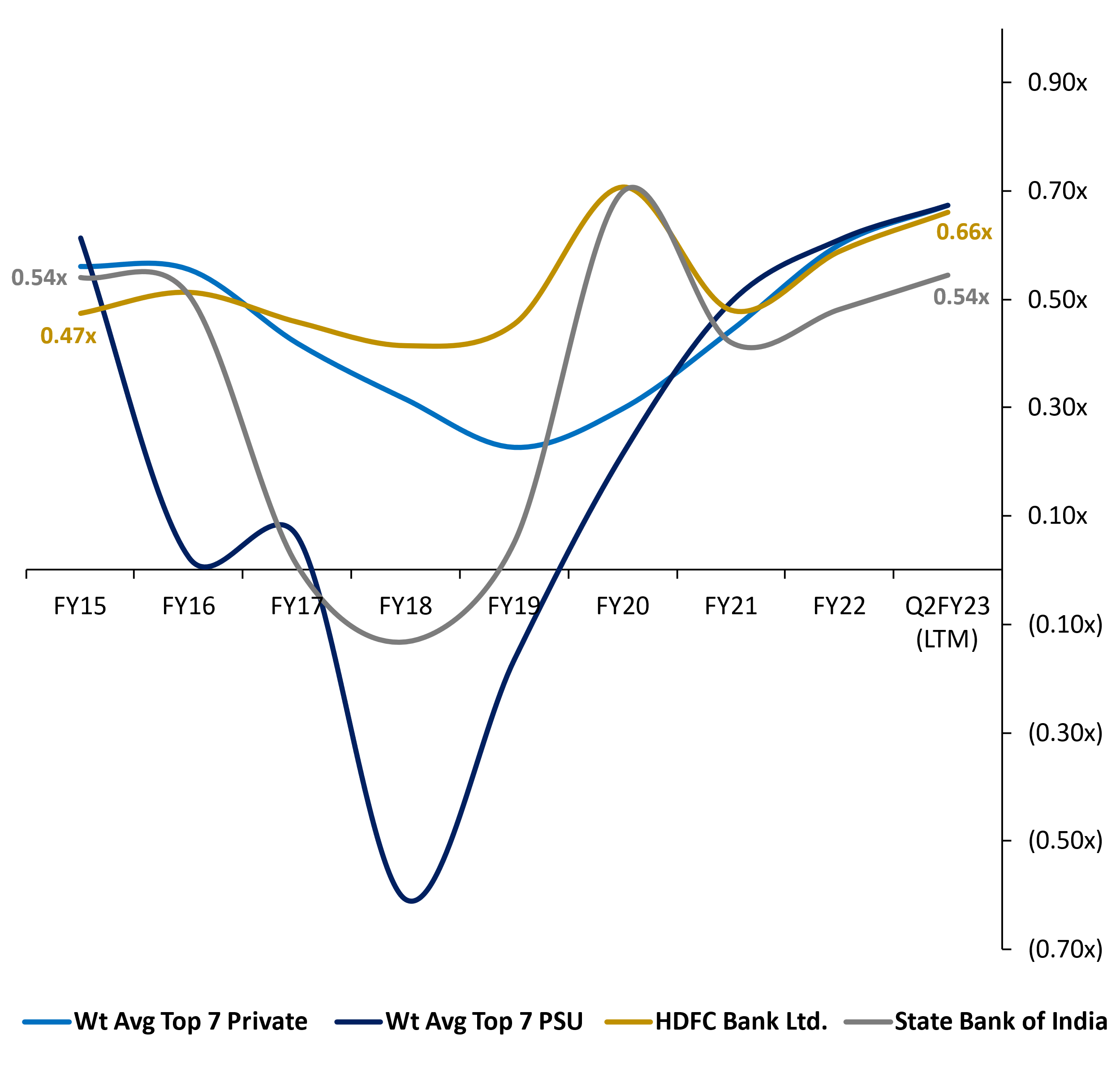

How TresVista conducted a study to analyze Banking Valuation Multiples

The Context

The TresVista team conducted a study to understand the correlation between valuation ratios of different banks, by leveraging internal databases, and forming an intuitive graph to understand the ground reality. The task also included to better understand the valuation premium differences between listed PSU and listed private banks. Moreover, the task entailed to bust the myth that anything ‘government’ or ‘PSU’ isn’t cheap, and the market is, at least in this sector, efficient enough to allocate multiples basis performance, and no other external factors.

The Objective

To create an intuitive chart explaining the long-term trends through a graphical representation of key ratios for all listed banks in India by leveraging internal databases.c

The Approach

The TresVista Team followed the following process:

• Comprehended the operations of a bank and the typical road to its profitability

• Compared ratio differences between a bank and a non-bank company

• Compiled data on key ratios (RoA and P/B) for all listed banks in India leveraging internal databases

• Transformed findings into an intuitive chart to understand long-term trends

The Challenges We Overcame

The major hurdles faced by the TresVista Team were:

• Unavailability of directly applicable literature

• Outliers in the dataset

• Sanctity related gaps arising from leveraging different databases

• Compressing the entire study in a single intuitive output

The team overcame these hurdles by leveraging insights and coverage on similar topics and successfully connected the dots to formulate the RoA-P/B correlation metric. Additionally, the team sliced-and-diced the raw dump to eliminate outliers and investigated whether undervaluation actually exists. Finally, the team compressed all final findings into a single graph to help the reader understand the nuances behind the deviations in the chart across the pre-defined timeframe

Final Product

The Value Add – Catalyzing the Client’s Impact

The TresVista Team provided the client with a template for executing similar studies in the future.