Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

How we assisted a Private Equity firm in Africa with tracking the performance of their debt portfolio

The Context

The client, a Private Equity firm based in Africa, wanted to control the inflow/outflow of the fund and track the performance of their COVID-19 emergency fund at both fund and portfolio level. The model would keep track of the portfolio companies and their respective debt schedule and be able to combine them to see the impact on the fund.

The Objective

To build a financial model that projects the associated cash flows of the COVID-19 emergency fund, calculates the gross and net IRR, and has the flexibility to include mezzanine/equity features.

The Approach

The TresVista Team divided the model into two parts:

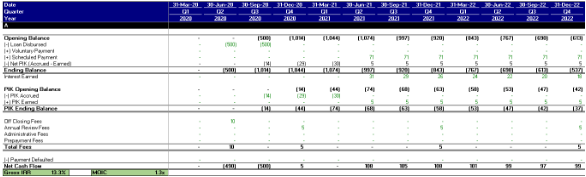

- Portfolio Level: Created individual debt schedules for 20 companies with placeholders for more. These schedules had an option to avail a moratorium period with a bullet PIK, gross IRR, and MOIC calculations

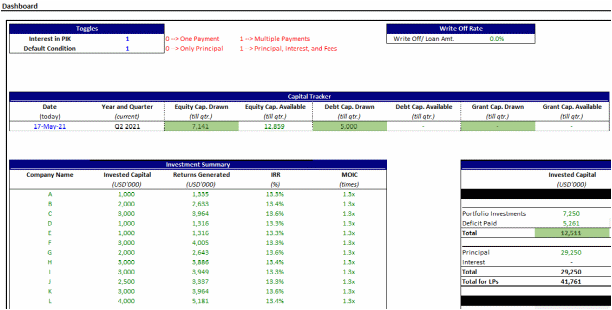

- Fund Level: Created a waterfall that shows the distribution of proceeds between LPs and GPs along with a catch-up clause

The model worked on two-time frames: an investment period of 2 years and a harvest period. The time zones were flexible to accommodate any changes.

The Challenges We Overcame

The challenges faced by the TresVista Team were:

• Customizing the model for inputs like re-investing the proceeds during the investment period

• Allocation of funds during an initial time when companies availed the moratorium period

• Striking a balance between the timing of three sources of cash namely, debt, equity, and grants

• Analyzing the variation in IRR under multiple scenarios

Final Product (Sanitized)

The Value Add – Catalyzing the Client’s Impact

The TresVista Team customized the model by including a flexible dates functionality, which made the model useable for any future funds and with different time horizons. A dashboard was created by the TresVista Team to show the portfolio and fund summary along with a write-off functionality to adjust for the volatility in the African market. The model helped the client streamline their investment process and visualize a profitable time horizon and will also be used for future funds.