The client, a financial advisory team based in Africa, wanted the TresVista team to develop a financial model and investment memorandum for a real estate project in Africa. The client was looking to kick off a new mandate with a real estate company (Company A). The mandate was to provide capital raising services for the development of the primary infrastructure needed for the construction of residential and commercial real estate complexes.

To develop a project finance model and investment memorandum for a real estate project.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

The TresVista team overcame these hurdles by setting up immediate calls with the client anytime a roadblock was hit which helped save time and also understand the deliverable and expectations of all the stakeholders in a better manner. Also, the circular reference problem was rectified with the use of macros in the model.

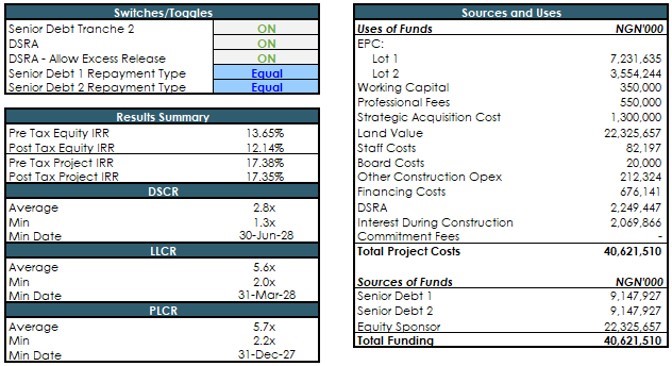

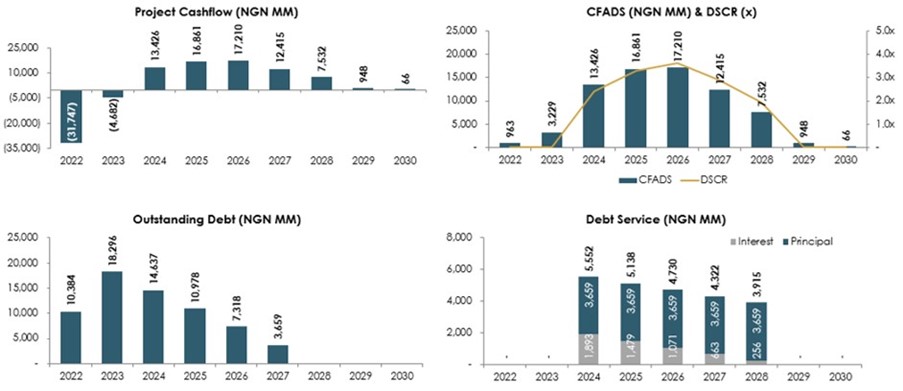

The TresVista team conducted a debt sizing analysis which computed the amount of debt the project can afford based on its projected cash flows and the target DSCR ratio. Moreover, the team built in multiple repayment profiles for the debt raised which enabled the client to analyze alternative scenarios that would result in the highest returns to the company.