Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

How we helped a Private Equity client in building a Dynamic Base model for Multi-Level Acquisitions

The Context

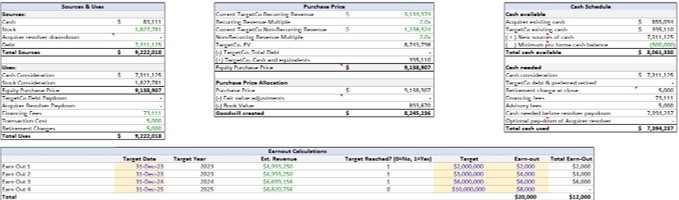

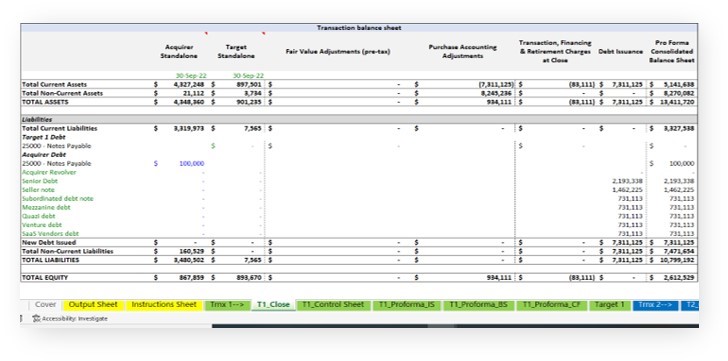

The client, a Private Equity firm, wanted the TresVista team to build a custom acquisition model with accretion/dilution and sensitivities analysis on top of the acquirer’s projection model where the client could easily modify the assumptions and deal structure. The broader task was to account for three acquisitions over the next year and create a model with proforma calculations, including seller paper and earn-out calculations.

The Objective

To build an efficient and memory-light model where future transactions can be easily added by duplicating the latest target and proforma tabs, making it accessible for the client to utilize as a base model.

The Approach

The TresVista team followed the following process:

- Template Preparation: Prepared three tabs for Performa IS, BS and CF, Control Sheet, and Close Sheet

- Finalized Transaction: Finalized the first transaction after receiving client approval, which was further replicated for two additional transactions

- Final Deliverable: Created a final output sheet with consolidated income statements after each transaction and accretion/dilution and sensitivities analysis

Final Product (Sanitized)

The Value Add – Catalyzing the Client’s Impact

The team constructed a multi-layered format such that the post-acquisition pro-forma statements were a combination of the previous consolidated company and the new target. Every time a new target was acquired, the pro-forma financials of the previous transaction became the base for the new one. The team created on-off switches for the optional pay-down of the acquirer revolver, Section 336(e) election, earnout calculations, and a kill switch for the transactions.