The client, a Private Equity firm, wanted the TresVista team to enhance their asset management practices by developing a process to verify the valuation marks provided by the borrowers (PE fund GPs). The aim was to independently sense-check the NAV calculated by the borrower, typically based on trading multiples. Further, the client wanted to understand the qualitative reasons behind the movement in multiples during the period. The client also wanted the process to be as streamlined and as efficient as possible to be rolled out across several investments made by their fund, where each portfolio financing deal involved lending to the GP against a portfolio of 5-7 companies.

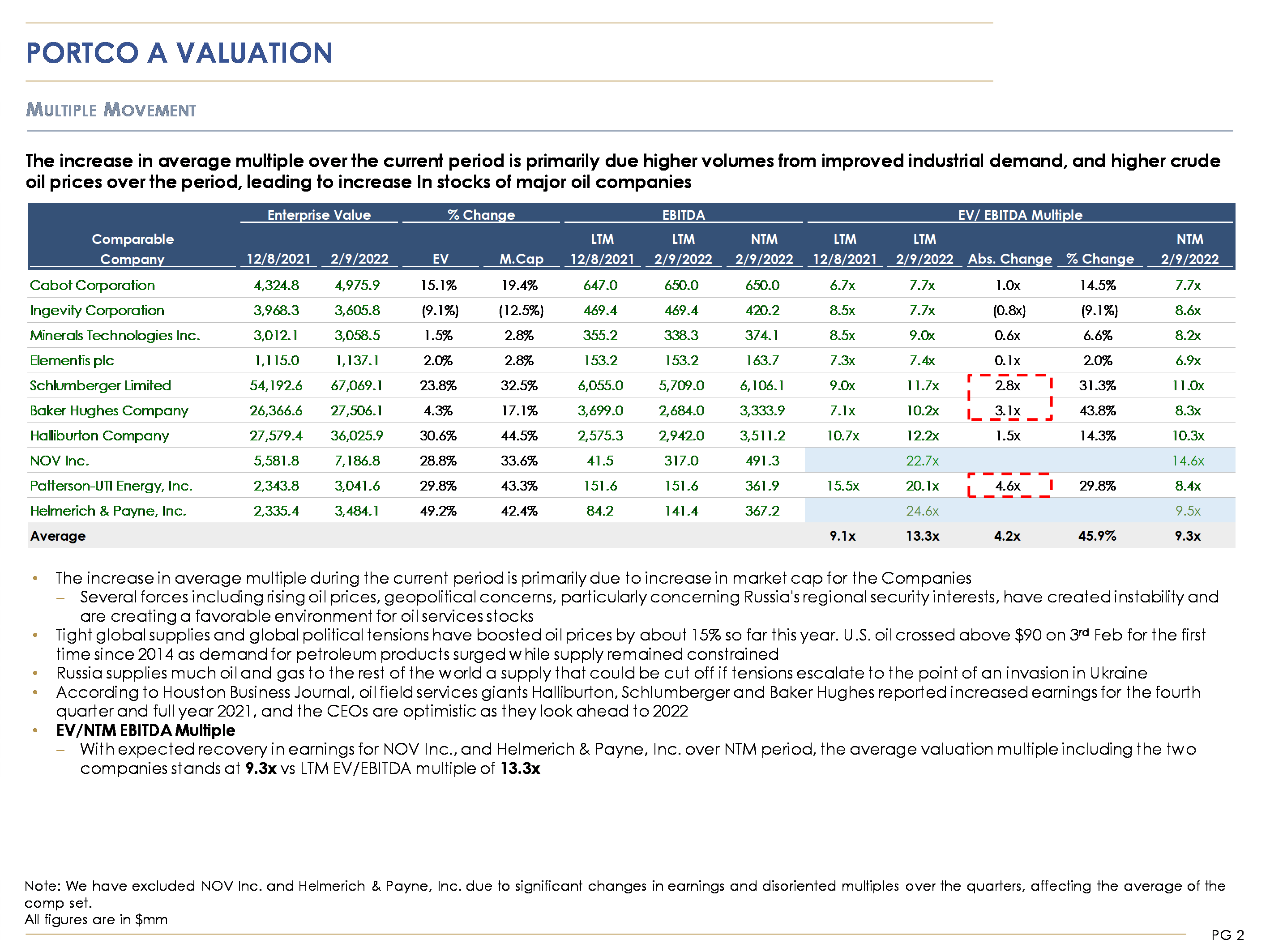

To prepare a quarterly review, analysis, and discussion deck for monitoring valuations across the client’s secondary credit portfolio.

The TresVista team followed the following process:

The major hurdle faced by the TresVista team was getting a general sense of the relevant factors within the different industries since each deal was a pool of portfolio companies often operating across industries and geographies. Also, condensing the information and limiting the time spent, especially while working with new industries and maintaining the relevance of the data points, was a challenge.

The TresVista team overcame these hurdles by referring to the investment decks shared by the client to develop familiarity with the client’s assets. The team also referred to the news and related articles to get a general understanding of the functioning of the industries. Over time, the team worked on refining and evolving the output to better suit the client’s needs so that it added value to them.

The TresVista team added value by adding summarized commentary and cross-cycle charts to the analysis to enhance the level of information conveyed. The process was designed to be robust, scalable, and entirely manageable by the TresVista team, freeing up valuable resources at the client’s end.