The client, a Private Equity firm, wanted the TresVista team to prepare a fund returns projection model incorporating metrics like projected contributions, carried interest, management fee, etc., to assist in decision-making with respect to asset exits. The client had prepared separate models for each of their funds but wanted the TresVista team to prepare a template that would simplify the process of updating the data and make the final file customizable for each fund strategy. The client also wanted the team to incorporate functionalities to ensure the comparability of data and ease of analysis.

To build a fund returns projection model template that would help with communication with the LPs and decision-making.

The TresVista team followed the following process:

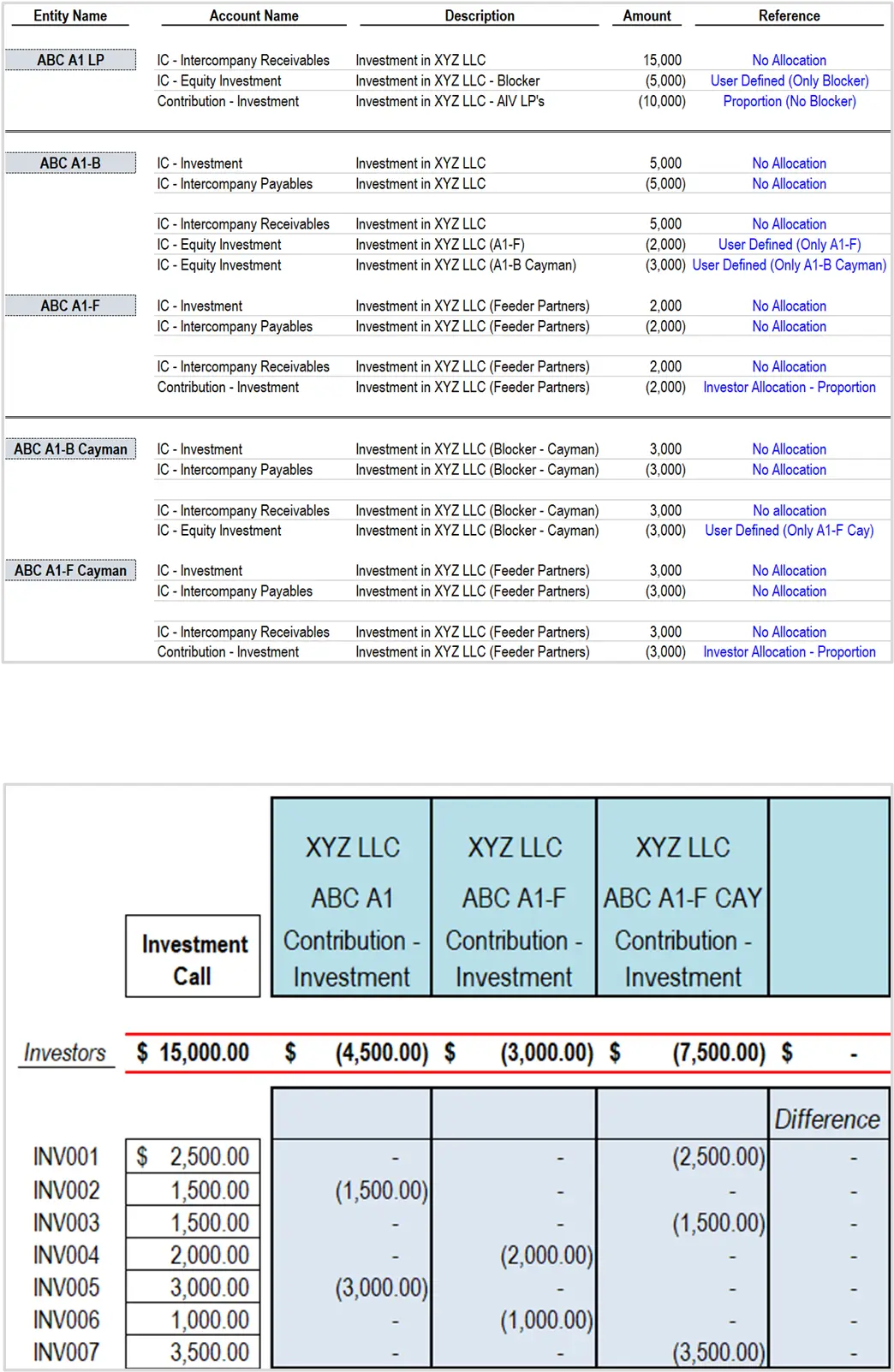

Created a Template: Took one fund as the base to build the template and subsequently added functionalities for other funds

Dynamic and Intuitive Features: Structured the file to calculate both American and European waterfall structures and built asset-wise tabs to show data at a gross level

Rolled up the data at a Fund Level: Arrived at fund level calculations for Contributions to Investments, Management Fee, Carried Interest, etc., to calculate the projected Net IRR and MoC

The major hurdles faced by the TresVista team were incorporating various functionalities specific to different fund strategies, incorporating a complex American distribution waterfall without access to the LPAs, and finding ways to apportion asset-level fund expenses. The team had to work with multiple stakeholders and hence needed to align with the broader objective.

The TresVista team overcame these hurdles by constantly communicating with the client to better understand their fund terms and adjustments better and get clarity about the most sensible approach. The team connected with the client over multiple calls and updated the file to incorporate the adjustments that different line items would need for funds with different strategies.

The TresVista team suggested additional functionalities to the fund returns model such as different distribution waterfall toggles, exit scenario analysis, etc., and incorporated multiple dashboards that would visually display the required metric analysis to facilitate decision-making. The team also prepared a document highlighting the specifics of each of the formulas used along with a user manual. The template created by the TresVista team ensured consistency across data used, while also being customizable for various stakeholders.