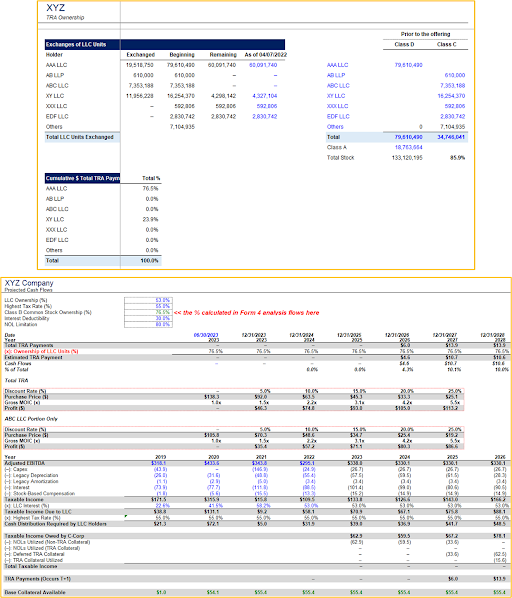

The client, a Private Equity firm, asked the TresVista team to create a preliminary model to review the future payments generated by the asset class, to analyze the collateral that would be required to pay-off the liability, to analyze the shareholding by the Class B/pre-IPO holders and calculate their percent of the total TRA payments. The client also asked to identify the TRA liability and total collateral based on the liability, to create a collateral waterfall to spread out the collateral, to forecast taxable income, payments and create a returns summary, and an analysis of the exchanges by the pre-IPO holder to identify the Class B percent.

To build a preliminary model to forecast the total and individual holders’ future TRA payments.

The TresVista team followed the following process:

• Populated the historical data for the NOL balance, TRA liability and other line items to calculate the taxable income

• Calculated the total collateral created for each historical year based on the TRA liability and spread that collateral across 15 years

• Forecasted the taxable income and TRA payments and ran a Form 4 analysis to identify the exchanges done by the pre-IPO holders to identify the percentage of payments attributable to each holder

• Used this percentage to identify the proportion of total TRA liability attributable to each holder and created a returns summary to identify the IRR, MOIC and profit across different discount rates

The major hurdles faced by the TresVista team were:

• Developing an in-depth understanding of the esoteric asset class for which very less amount of information is available

• Identifying the holders not provided in the beneficial ownership section and their respective exchanges

• Involvement of a lot of subjectivity in some parts of the analysis which varied from company to company

The team overcame these hurdles by doing extensive research regarding the workings and nuances of the asset class. The team had a template given by the client which helped them understand the working of the model and the analysis that was required to be done. The team then created a process document to identify the steps that were needed to be performed while working on the workstream and identified sections in the public filings to pin-point the sections that were common across companies to make search of information easy. The team also identified the subjective cases and analyzed the reason for the same and tweaked the model to account for the subjectivity.

The TresVista team helped the client understand the returns that the asset class was generating and the various details regarding the future prospect of generation of TRA liability and tax savings. The client also got a sense of the Class B holders and the holders who can be targeted based on their Class B percentage to purchase the TRA from. The team added different checks in the model to make sure that it is flowing correctly and provided the client with a detailed analysis and different assumptions with regards to TRA ownership to help them identify exchanges of LLC units by various TRA holders. The team also added relevant notes and comments in the files for better understanding of different structures of the companies.