Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

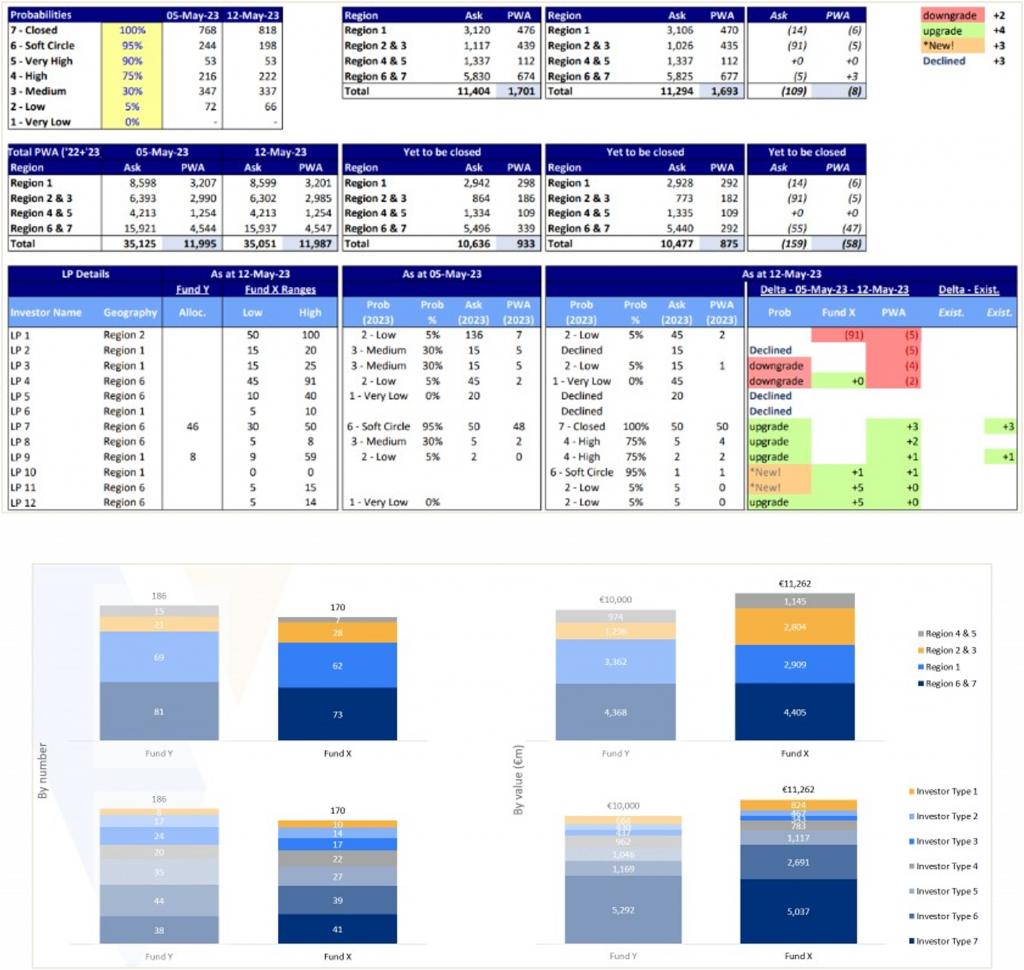

How we helped a Private Equity client to create a Fundraising Tracker

The Context

The client, a Private Equity firm, asked the TresVista team to create a fundraising tracker using data dump from their CRM to summarize all the LP movements over the course of the fundraise, on a weekly basis. The output was required to signify the key movements in the total ask based on different criteria, along with specific LPs with notable movements.

The Objective

To create a fundraising tracker using data dump from the client’s CRM to summarize all the LP movements over the course of the fundraise, on a weekly basis.

The Approach

The TresVista team followed the following process:

• Understanding the Source Data and Digesting Information: Examining and understanding the initial data dump to determine the usefulness of the available categories/sets and visualize the analysis

• Creating an Organized Master Tracker: Creating an automated worksheet to pull the necessary data, as redefined per the fundraising jargon, for every weekly data dump to be received

• Rectifying any Data Mismatches: Checking for any inconsistencies in the shared dump and across data dumps relating to the LP names and details, closing categories and probabilities

• Creating the Weekly Comparison Output: Creating an automated output tab comparing the ask and PWA corresponding each LP and tracking the ‘upgrades,’ ‘downgrades,’ ‘declines,’ ‘new’ and ‘deleted’ LPs

• Generating Additional Analysis & Insights: Charting out the current and previous fund attributes by region of LPs, type of LPs, number of investors, average size, and maximum and minimum investment

The Challenges We Overcame

The major hurdles faced by the TresVista team were:

• Standardization of the process owing to inconsistency in data format

• Rectification of any discrepancies in the source datasets

The team overcame these hurdles by creating the master tracker which helped the team standardize the data set and also make any updates in naming convention and discrepancies.

Final Product

The Value Add – Catalyzing the Client’s Impact

The TresVista team removed time-consuming iterative steps and created a tail analysis that funnels down to the LPs who have been closed and LPs actionable for the specific fund. The Team also bridged the fundraising activity from the initial week to the most recent week over the 2 years to evaluate the progress and kinds of fundraising movements.