Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

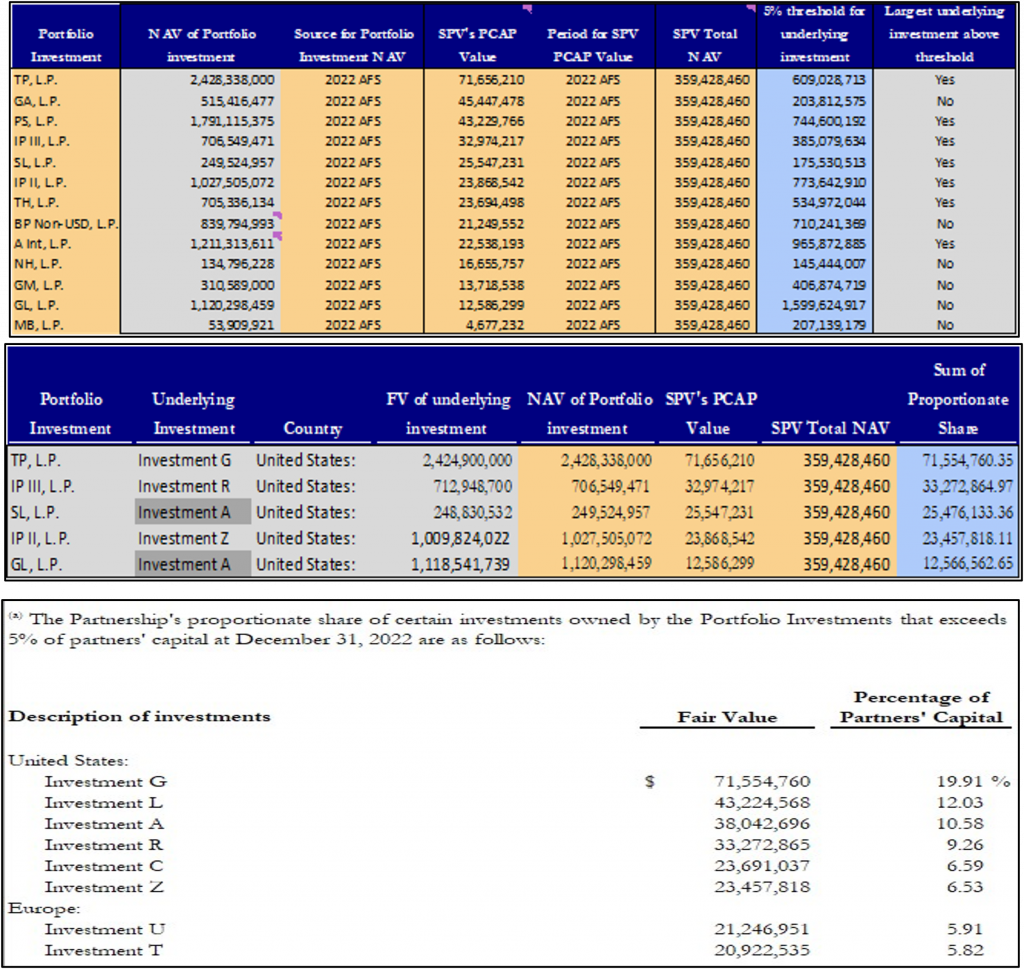

How we helped a Private Equity client to prepare a Disclosure Note for the Schedule of Investments

The Context

The client, a Private Equity firm, asked the TresVista team to prepare a disclosure note for the Schedule of Investments for investments that exceed 5% of partnership Capital at the balance sheet reporting date which included scrutinizing investments that may have exceeded the threshold limit, ascertaining the geographical location of such investments, computing the sum of the proportionate share of portfolio investments, and verifying the aggregated amounts with respect to the same general partner.

The Objective

To prepare a disclosure note for the Schedule of Investments for those that exceed 5% of partnership Capital at the balance sheet reporting date.

The Approach

The TresVista team followed the following process:

• Calculating 5% threshold for underlying Investment: Calculating the 5% threshold for the underlying investment as “5% * (SPV Total NAV/SPV’s PCAP value) *NAV of portfolio Investment”

• Checking investments above the threshold limit: Skim through the Portfolio Investment’s SOI and identify the investments above the threshold

• Identifying geographical region of underlying investments & categorizing them: Identifying and updating geography of the underlying investment along with a screenshot of the source

• Checking aggregate over Same GP and calculating final values: Aggregate the underlying investments above 5% across the same GP. Creating pivot table for calculating the final values for the disclosure note

• Preparing SOI Note Disclosure: Adding the 5% look through disclosure note in the SOI when the partnership’s proportionate share of investments exceeds 5% of partner’s capital

The Challenges We Overcame

The major hurdles faced by the TresVista team were:

• Non availability of reliable and up-to date data

• Ensuring consistency in data interpretation across all investments and keeping track of any changes in the investments over time

• Large amount of data to be analyzed for investments across several portfolios in short turn-around timelines keeping in mind the audit timelines

The team overcame these hurdles by creating a consolidated template to help in calculating the threshold limit for each investment, scrutinizing investments that may have exceeded the threshold limit, computing the sum of the proportionate share of portfolio investments, and verifying the aggregated amounts with respect to the same general partner. The team also identified and set a standard priority order to ascertain the geographical location of such investments and categorize and group investments accordingly.

Final Product

The Value Add – Catalyzing the Client’s Impact

The TresVista team helped automate the template to provide valuable insights into the underlying investments, potential risks and their impact on the overall portfolio and provided a structured process to assist the clients with their review.