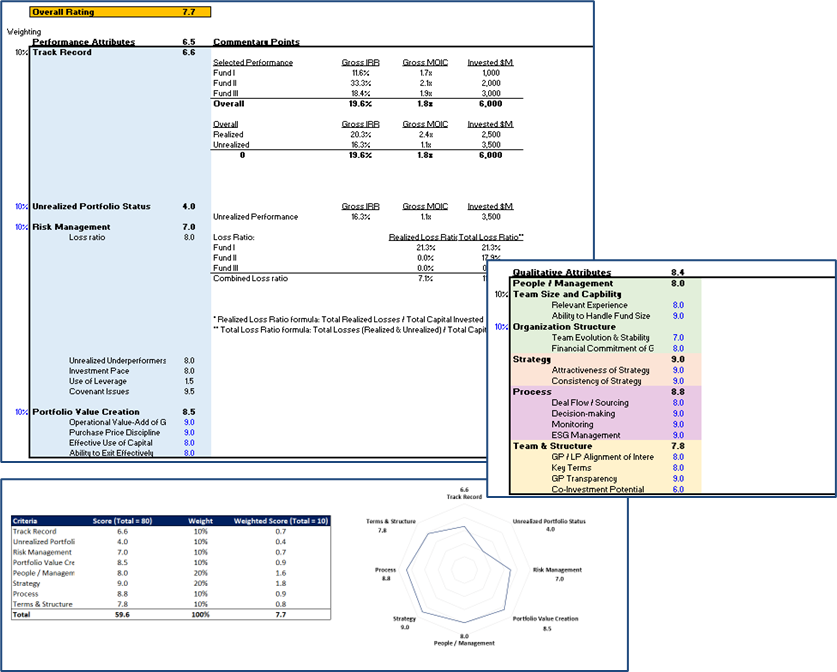

The client, a Private Equity firm, asked the TresVista team to prepare a detailed weighted scorecard as a part of the fund diligence process. The scorecard generates an overall score for various quantitative/performance and qualitative attributes basis a detailed analysis and research on the fund. Along with the score, concise commentary is provided for each attribute. The scoring for the quantitative section, that is, the performance section is to be done basis set metrics/ranges, while the scoring for the qualitative section is subjective and based on the understanding of relevant data available.

To prepare a fund scorecard which would help assess various quantitative and qualitative attributes.

The TresVista Team followed the following process:

• Poured over diligence materials and conducted reference calls to build a perspective on GPs investment philosophy, process, team, and track record

• Populated quantitative and qualitative sections:

◦ Quantitative Attributes: Fed performance of previous funds, including loss ratios, Net IRR, and Net MOIC, along with commentaries for attributes such as leverage, use of capital, etc.

◦ Qualitative Attributes: Commented on the GPs strategy, process, and ability to manage the funds historically

• Benchmarked and scored the quantitative attributes basis set criteria and the qualitative attributes based on the understanding of the GP dynamics with respect to the peers

• Calculated the overall weighted score across all the attributes

The major hurdles faced by the TresVista team were:

• Subjectivity in certain attributes, for example, financial commitment of GP and GP / LP alignment of interest, was one of the main hurdle

• Understanding the scoring criteria provided by the client and taking a call on the rating to be assigned based on the fund’s approach to each attribute

• Inputting all the available information in a concise manner while it still being relevant to the attribute

The team overcame these hurdles by reaching out to the client who further reached out to the GP of the fund in diligence to seek clarity on the attributes. Additionally, the team referred to the GP’s materials to gather additional information. The team also had an extensive discussion with the client to understand their rationale and expectations around the scoring. Moreover, with multiple iterations of the project, the team was able to grasp the accurate way of presenting the commentaries.

The TresVista team identified an appropriate approach to complete the diligence to match the client deal flow and reduced the overall processing time. They also incorporated back-up calculations in the file for easier access to the data utilized for marking the scores in the performance section. Additionally, the team created custom categorizations for marking the unrealized portfolio (level of underperformance, with or without covenants) basis the requirement for each fund, which further provides weightage basis the level of underperformers. Apart from the client requested topics, the team also deep dived into the fund materials to provide the client with diligence questions for assisting in the overall process.