We use cookies on our website to help you navigate efficiently and perform certain functions. A Cookie is a small piece of data (text file) stored on your computer or mobile device by your web browser. We may use Cookies to personalize the content that you see on our Website and to identify the areas of our Website that you have visited.Those cookies are set by us and called first-party cookies. We also use third-party cookies that help us analyze how you use this website, store your preferences, and provide the content and advertisements that are relevant to you and aide our marketing efforts. Most web browsers can be set to disable the use of Cookies. However, if you disable Cookies, you may not be able to access functionality on our Website correctly or at all.

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

In addition to cookies, some information may automatically be collected as you browse our Website, such as type of browser, operating system, domain name or IP address.

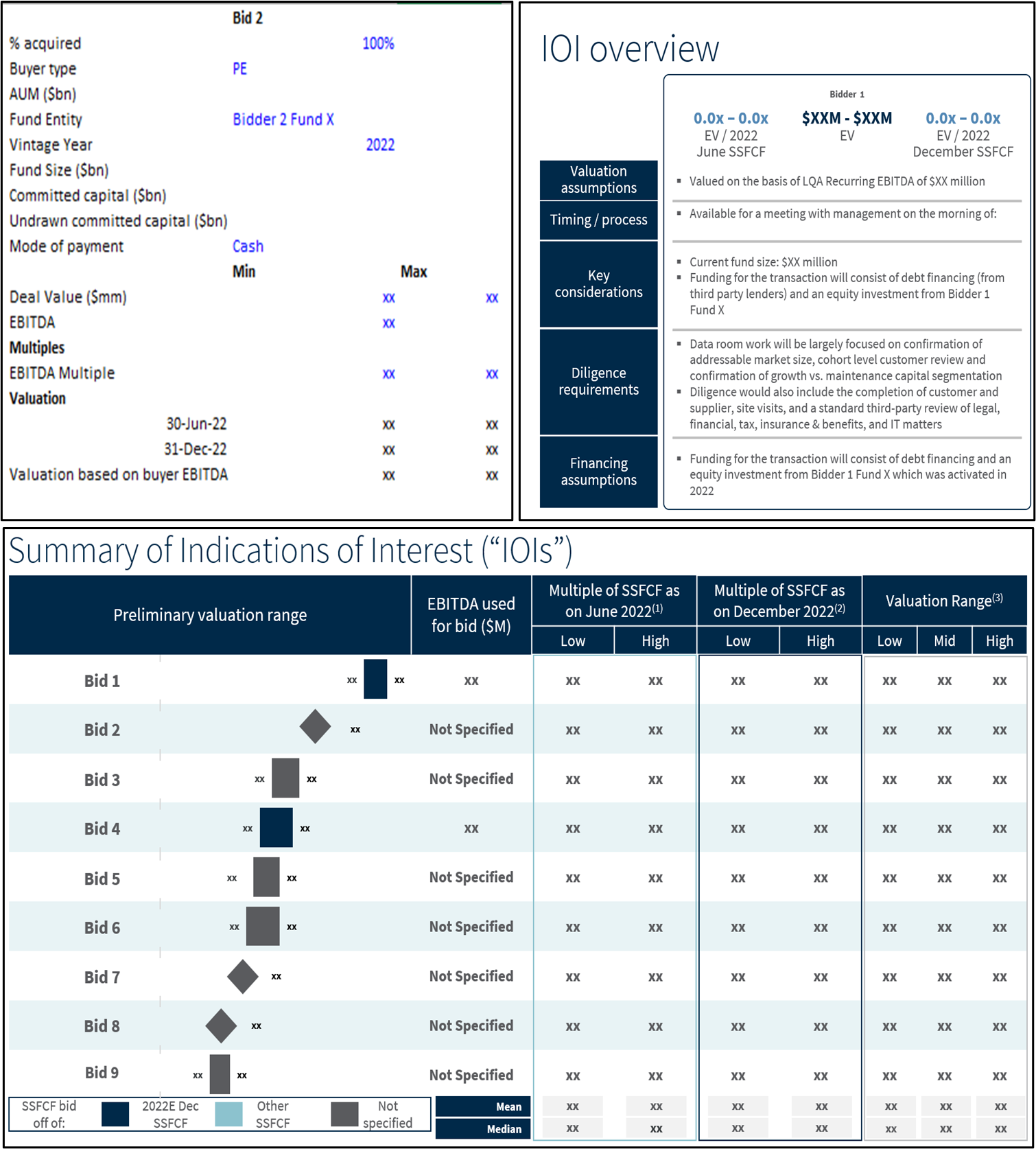

The client, an Investment Bank, asked the TresVista team to summarize bids for the sale of a company, including research on potential buyers for the outreach process, modeling the disparate bids into a model to facilitate comparison for valuation purposes and creation of a consolidated presentation deck for better understanding of the offers received.

To build a bid summary model to analyze and represent various bids in terms of multiples and valuations offered to the client.

The TresVista team followed the following process:

• Research: The team understood the client’s business, created a preliminary buyer’s pool to send the outreach mails to, researched on buyer’s investment criteria and industry focus, and streamlined to a core set of buyers to send the outreach mails to

• Valuation: The team comprehended the valuation of each buyer stated in their respective IOIs (Indication of Interest), prepared a base model considering all the valuation multiples and covenants mentioned, and summarized the implied EV resulting from the said multiples

• Analysis: The team standardized various multiples provided, such as, converted a bid received in ARR multiples to EBITDA multiples, compared various implied EV, ARR and EBITDA multiples to identify viable offer

• Representation: The team finally prepared comprehensive presentation consolidating all the offers presented with the help of graphical exhibits and detailed buyer profiles

The major hurdles faced by the TresVista team were:

• Magnitude of buyers in the tech-space given the boom witnessed by the industry in recent years

• Analyzing each PE sponsors’ distinct approach in valuing and presenting their opinion on the asset offered

• Standardizing the multiples across bids to provide the client with uniform data

• Urgency of the request due to the push from the client to close the deal

The team overcame these hurdles by identifying peer companies in the sponsor’s portfolio to evaluate the best fit and creating distinct models in real-time as and when the bid was received. The team tried to understand the metrics and the steps included to create them, to arrive at the resultant multiple.

The TresVista team suggested the entire bid model by leveraging the practices applied by a peer team for their client. The team also provided a checklist of primary valuation multiple driving the bids to help understand the strategic motives of the buyers along with the addition of Due Diligence requirement mentioned on IOIs highlighted in the buyer profiles.