The client, a Middle Market Investment Bank, wanted the TresVista team to analyze the costs involved in a DeSPAC transaction. The client requested the team to perform research on finding each of the granular components of the total costs and analyze it as a percentage of offering costs and deal size.

To analyze the costs involved in a DeSPAC transaction along with research the granular components of the total costs.

The TresVista team followed the following process:

• Performed the desktop research along with the Capital IQ screening to scout the potential DeSPAC transactions happened in the last one year

• Studied the various stages of the DeSPAC deal cycle along with the various components of expenses incurred

• The S1 filings were leveraged to source the offering and the estimated underwriting costs whereas the proxy statements/S4 filings were used to capture the acquisition deal size along with the actual deferred underwriting fees component

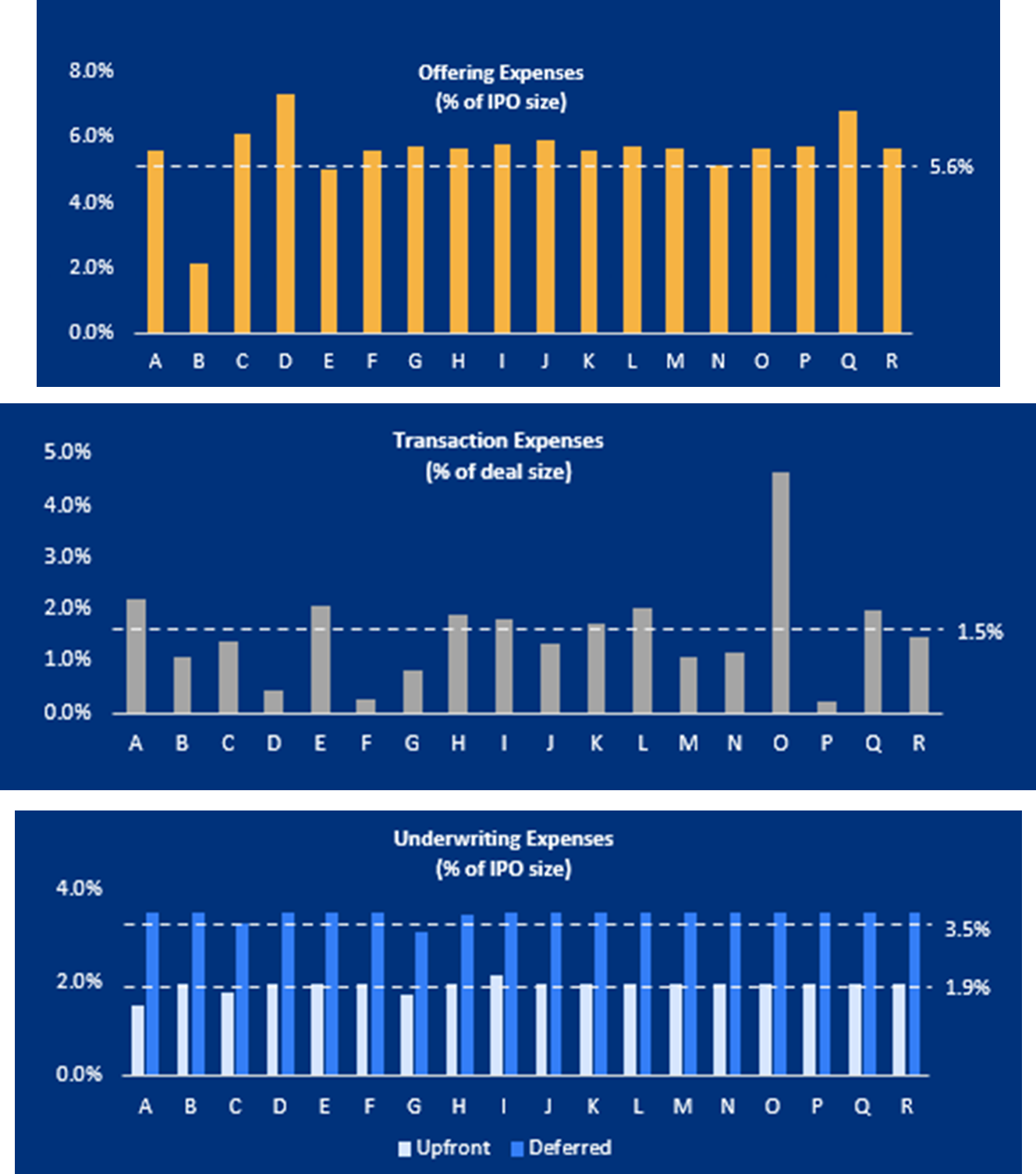

• The final deliverable included the granular breakdown of the different components of offering costs and the transaction expense

The major hurdles faced by the TresVista team were:

• Spent considerable amount of time on researching the information pertaining to some parts of the costs that were not readily available in the SEC filings

• Urgency of the request given the push from the end client to close the deal within the desired timeline

The team overcame these hurdles by studying various stages of the DeSPAC deal cycle and learning about the fact that the firms tend to include the deferred underwriting fees component both in offering costs as well as in the business combination expenses.

The TresVista team provided a summarized view of all the transaction components along with visual representation in a short duration of time.