The client, a boutique Investment Bank, wanted the TresVista Team to evaluate a list of shortlisted companies in a particular industry/sector as a potential acquisition target. The client asked the team to provide in-depth information on all six target companies, highlighting the associated risks and opportunities for each of them to evaluate all the acquisition candidates objectively and rate them based on the parameters provided by the client.

To evaluate acquisition candidates and provide an objective rating based on the parameters defined by the client to enable the company to make a well-informed decision after weighing in their strategic objectives.

The TresVista Team followed the following process:

The major hurdles faced by the TresVista Team were:

The team overcame these hurdles by segmenting the company research into broad and obtainable categories while looking at regional news reports and websites to collect additional data for specific companies. Additionally, all the data available in regional languages were translated using public source software, and the distorted financials were recreated in excel for better readability and understanding. Further, the team researched to validate all the translated information and fill in the research gaps.

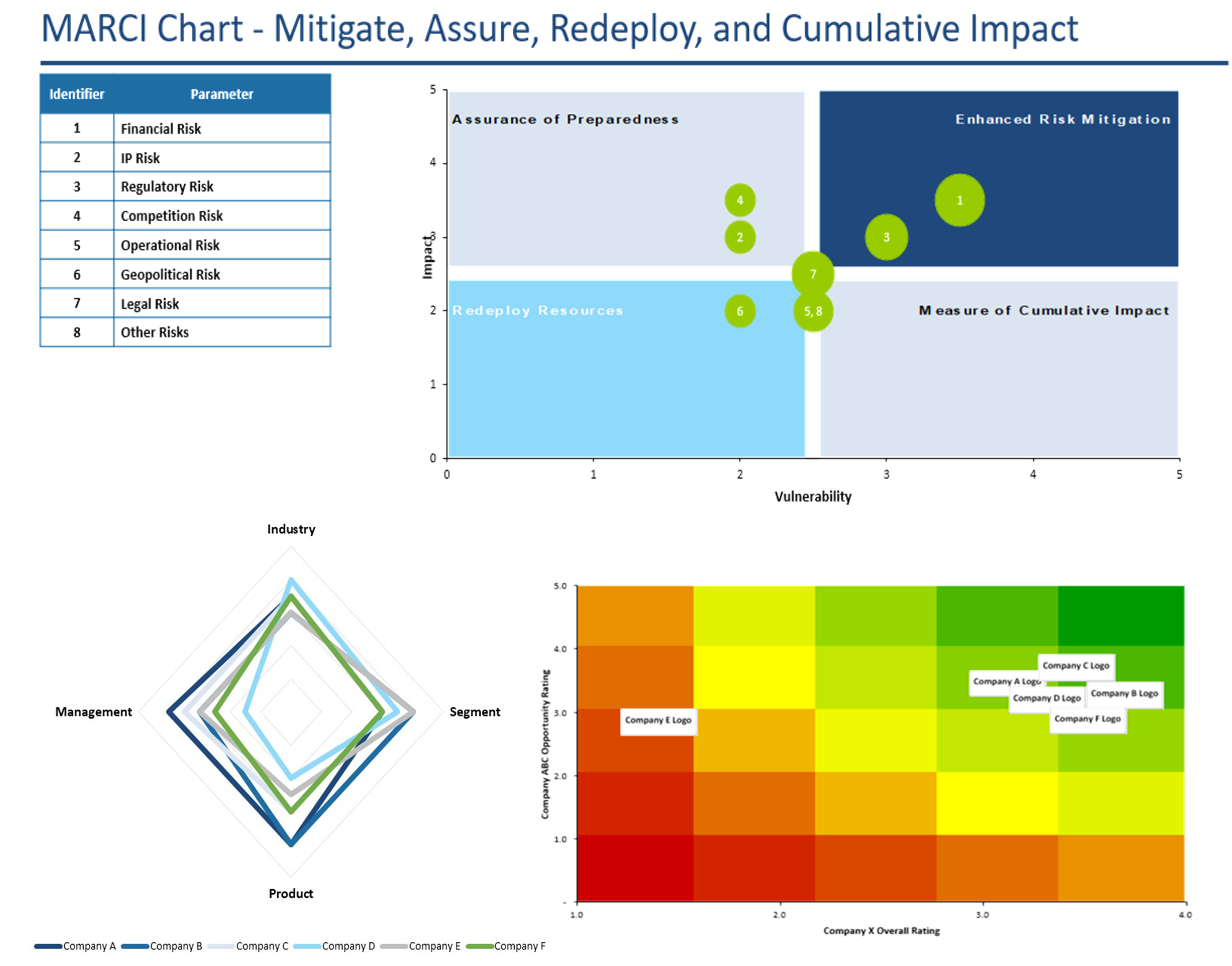

The TresVista Team built an interactive excel file for the client to modify the weights or ratings associated with a parameter, allowing them to visualize the results instantaneously. Moreover, the team identified additional parameters to gauge the opportunities presented by each of the target companies. The team further added individual company tabs, which were auto-updated based on the primary tab and provided a detailed breakdown of each company.