The client, a Private Credit firm, wanted the TresVista Team to conduct a high-level deal read on the borrower with the help of the Confidential Information Memorandum (CIM) and recommend if the client should pass the deal or move to Phase 1 for further diligence.

To create a brief summary describing the business, the economic model, investment highlights, risks & mitigants, key due diligence items, and provide a recommendation with the help of the CIM provided by the client.

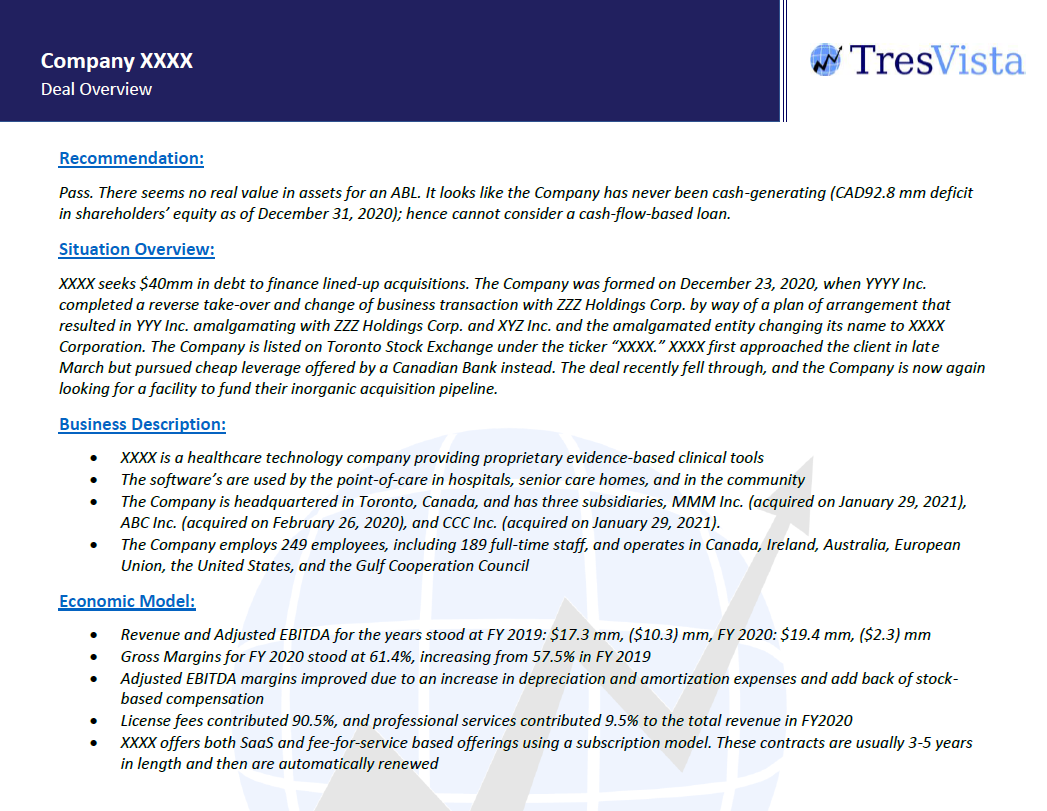

The TresVista Team worked on the following points to arrive at a recommendation for the client:

The hurdles faced by the TresVista Team were understanding various businesses only through the CIM summary and keeping away the marketing noise to arrive at a reasonable conclusion.

By avoiding the marketing fluff, the TresVista Team provided a concise description of the business and highlighted the key financial KPIs, gave an overview of risks / merits of the deal, and suggested further due diligence questions, which helped the client to frame the next call with the borrower. The task helps save crucial time by passing deals that were not relevant and enables the client to screen through more deals and focus on the more important ones.