The client, a Real Estate Investment Bank, wanted to run a valuation and leverage analysis for Commercial Real Estate advisory companies. The purpose of the valuation analysis was to understand the performance of the companies while the purpose of the leverage analysis was to understand the indebtedness of the companies over time and against each other using leverage ratios like Debt/Equity, Debt/Total Assets, etc.

To conduct a market valuation and leverage analysis of Commercial Real Estate advisory companies to understand the trends and changes in their valuations based on quarterly performance.

The TresVista Team started analysing the financial statements and calculated the financial indicators like adjusted EBITDA and Enterprise Value on a quarterly basis. After calculating the indicators, a valuation tab was created to show the company’s valuation multiples on a daily interval to understand the trend over time.

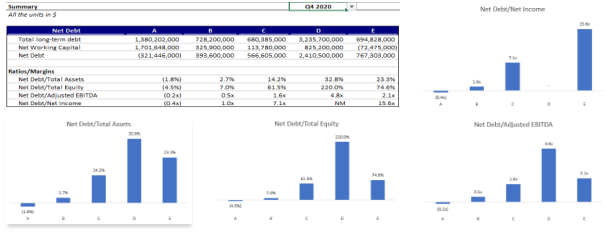

For the leverage comparison and analysis, the TresVista Team added a detailed schedule showing the various levels of debt taken by the companies which was used to calculate leverage ratios like Net Debt/Total Assets, Net Debt/EBITDA, etc.

The TresVista Team made a summary tab and utilized charts to facilitate easy peer-to-peer and trend comparison of the leverage levels of different companies. The analysis helped the client efficiently compare date over time and against peers.